- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

Prologue

For more than 4 years of her job life at an RMG factory, Kholi was never able to send her earnings to her family despite earning a decent amount of wage. By the 10th of every month, her wages would either be snatched by her husband waiting in front of the factory at 5 PM, or by her in-laws. This pattern witnessed a shift since January 2022 as Kholi now withdraws a portion of her earned salary by the 20th, and covers the rest by her overtime amount she receives on the 7th of next month. While Wagely may have supported Kholi, in her journey of financial wellness, unfortunately, a very similar fate is still shared by almost 2.5 million female workers in the RMG Industry.

A Gap Despite Growth

Bangladesh has witnessed remarkable economic progress in recent years, with the rise of digital wages being a transformative shift for millions of workers. Industries such as ready-made garments (RMG), manufacturing, and hospitality have embraced digital payroll systems, bringing greater efficiency and transparency to worker payments. However, while digitization has improved wage disbursement, until 2021, it did not necessarily translate into financial wellness for blue-collar workers. Rising inflation, unpredictable expenses, and limited access to financial resources continued to strain workers' ability to achieve financial stability.

For many, their income was just enough to cover daily expenses, leaving little to no room for savings, emergency funds, or long-term financial planning. When unexpected expenses arose, workers often turned to informal high-interest loans, borrowing-trapping them in a cycle of financial distress. Despite their hard work, financial security remained an unattainable goal for many.

This ongoing struggle raised an important question: What does financial health truly look like for these workers? To better understand their challenges, Wagely analyzed their financial behaviors and habits, uncovering critical insights into their spending, saving, borrowing, and planning patterns.

Understanding the Financial Health of RMG Workers

Financial health, a measure of how effectively individuals manage their financial resources, plays a crucial role in modern-day society. It encompasses the ability to cover expenses, save for the future, manage debt responsi- bly, and plan for long-term financial goals. Financial health directly impacts individuals' quality of life, influencing their ability to handle emergencies, pursue opportunities, and achieve financial stability.

In 2023, Wagely - Bangladesh's first holistic financial wellness platform, providing on-demand salary for blue-collar workers, published a report created through comprehensive surveys that documented the financial health of workers in Bangladesh, providing insights to guide strategies to better understand and improve financial wellness.

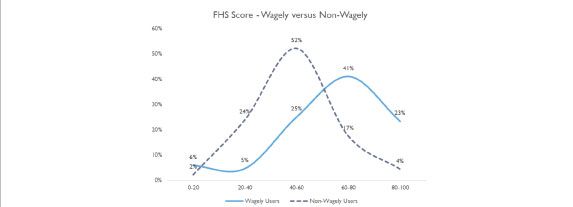

To evaluate the impact of financial wellness initiatives, the financial health of workers with access to these services was compared to a control group of workers from factories without such access. Workers with access to financial wellness services showed significantly higher financial health levels compared to the control group. While the report highlighted the significant positive impact of financial wellness services on users' financial health compared to non-users, it also underscored a crucial point-financial distress is not just about low wages but also about when and how workers access their earnings.

The Wagely Effect: A Step Towards Financial Empowerment

While traditional monthly payroll cycles leave workers vulnerable, often forcing them into desperate borrowing situations, Wagely's EWA model has supported businesses to disrupt the unhealthy cycle by allowing workers to access their earned wages anytime, reducing the need for costly loans and wage advances, and in return allowing them to be focused and productive at work.

The impact is evident in the data. Wagely users were more likely to fall within the "coping" and "healthy" financial health categories compared to non-users, who overwhelmingly struggled in the "vulnerable" stage.

Moreover, as an impact-oriented fintech, and a portfolio company of the Asian Development Bank (ADB), Wagely's contribution to conducting on-ground financial literacy workshops, resulted in higher awareness among wagely users, indicating that access to financial tools fosters better financial decision-making.

Leading the Financial Wellness Revolution in Bangladesh

Since its launch in 2021, Wagely has emerged as Bangladesh's first holistic financial wellness platform, serving over 270,000 workers across more than 150 factories. While the initial focus has been on the RMG sector, our expansion into industries like leather, footwear, and steel manufacturing signals a broader mission-ensuring financial inclusion for all workers, regardless of industry or income level.

Wagely's vision extends beyond just providing the On-demand salary service, popularly known as Earned Wage Access (EWA). Wagely has been at the forefront of nurturing long-term financial resilience by educating workers, advocating for better financial policies, and partnering with employers who prioritize employee well-being. By launching first of its kind prepaid card for the RMG workers in 2024, Wagely once again placed its priority on bridging the digital and financial wellness gap by offering a tool that supports the boost of accessibility for workers.

The journey to financial wellness is ongoing, but one thing is clear: when workers are financially secure, industries thrive, businesses grow, and economies strengthen. By bridging the financial wellness gap, wagely is not just offering a service-it is leading a movement towards a more financially inclusive and empowered workforce in Bangladesh.