- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

A Strategic Avenue for Growth, Cost Optimization, and Economic Expansion

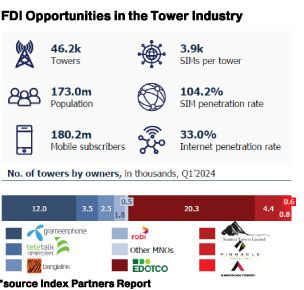

Bangladesh's telecommunications sector is experiencing rapid development, positioning the country as a potential hub for foreign direct investment (FDI) in infrastructure, particularly in the tower industry. The need for robust telecommunications infrastructure has become paramount as demand for digital connectivity grows, driven by a rising number of mobile users and increasing data consumption. This evolving landscape presents significant opportunities for investment, modernization, and broader economic benefits.

Bangladesh's telecommunications market, marked by around 45,000 towers, half owned by TowerCos and the remainder by mobile network operators 100% (MNOS), is evolving swiftly. As telecom operators look to optimize assets, the tower industry offers substantial potential for FDI. A case in point is Banglalink's sale of 2,000 towers in 2023 for $100 million, at an average of $50,000 per tower. This transaction underscores the potential for further investment in the country's infrastructure.

Bangladesh's telecommunications market, marked by around 45,000 towers, half owned by TowerCos and the remainder by mobile network operators 100% (MNOS), is evolving swiftly. As telecom operators look to optimize assets, the tower industry offers substantial potential for FDI. A case in point is Banglalink's sale of 2,000 towers in 2023 for $100 million, at an average of $50,000 per tower. This transaction underscores the potential for further investment in the country's infrastructure.

Projections indicate that Bangladesh will need approximately 10,000 additional towers within the next three years to meet the demands of growing mobile subscriptions and the roll-out of 4G services. This requirement highlights a clear opportunity for foreign investors to contribute to the expansion and modernization of the sector, with the potential for attractive returns. As the market prepares for 5G deployment, expected within two years, infrastructure investment needs will continue to rise, creating an opportune moment for investors to engage in one of South Asia's fastest-growing markets.

Enhancing Tower Market Attractiveness for FDI

Several operational strategies could be implemented to enhance the attractiveness of the tower sector for FDI. One approach involves diversifying revenue streams for tower companies by incorporating value-added services. For instance, towers can be adapted to host solutions like small cells, neutral hosting, and loT devices, supporting the development of smart cities and advancing sectors such as agriculture. These services not only add new revenue opportunities but also enhance technological integration across the economy.

Indoor connectivity remains a notable challenge in Bangladesh, where mobile data speeds often lag behind user expectations in heavily populated areas. Tower companies, in collaboration with mobile operators, could address this issue by investing in solutions that improve indoor network coverage. Shared infrastructure, such as neutral hosting, can help reduce costs and improve the quality of service, particularly in areas where high capital expenditure may be a barrier.

Additionally, the growing adoption of electric vehicles (EVs) presents an opportunity for telecom infrastructure to serve dual purposes. Leveraging tower sites as EV charging stations could generate new revenue while aligning with the country's sustainability initiatives.

The concept of active radio network sharing, where multiple operators use a single network infrastructure, also holds potential. This model, successfully implemented in other countries like Malaysia for their 5G networks, could be applied to Bangladesh's 4G coverage, particularly in rural regions. Such an approach would lower capital and opera- tional expenses, drive industry efficiency, and reduce the financial burden on individual operators.

Realizing the full potential of FDI in Bangladesh's tower industry will require policy enhancements and structural reforms. One of the most pressing needs is streamlining the approval process for tower construction. Obtaining necessary approvals can take six to twelve months, slowing the pace of infrastructure development. A more efficient, single-window system could help expedite this process, making the market more appealing to foreign investors.

Additionally, simplifying the tax structure for digital infrastructure investments is crucial. Taxes and fees consume nearly half of tower companies' revenue, limiting profitability and deterring investment. Aligning Bangladesh's tax regime with other developing Asian economies and offering specific incentives for investments in clean energy solutions could significantly improve the investment climate.

Energy costs represent approximately 40% of total expenses for tower companies, driven largely by diesel generator usage in remote areas. Policies incentivizing the adoption of renewable energy, such as solar power and advanced battery storage systems, could mitigate these operational costs while supporting national and global sustainability goals.

Future Outlook

The telecommunications sector plays a crucial role in Bangla- desh's broader economic landscape, contributing to GDP growth, job creation, and improving public services. By attracting foreign investment in its telecommunications infrastructure, Bangladesh has the opportunity to expand digital access, drive innovation, and accelerate its economic development.

In summary, Bangladesh's tower industry presents a compelling opportunity for foreign direct investment. Addressing key challenges such as the approval process, tax structures, and energy costs along with exploring new revenue streams could significantly enhance the sector's appeal. Such reforms would enable the development of a more resilient telecommunications infrastructure, driving long-term benefits for the economy and its citizens.