- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

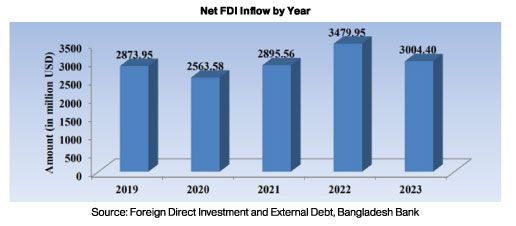

For Bangladesh, attracting higher volumes of FDI is not just a short-term necessity but a cornerstone for long-term economic sustainability. With the right policies in place, analysts believe Bangladesh could attract the foreign capital necessary to spur growth in underutilized sectors, diversify its economy, and create jobs. With the country on track to graduate from Least Developed Country (LDC) status by 2026, the clock is ticking for Bangladesh to boost its invest- ment appeal. FDI inflows fell 14% in Calendar Year 2023, down to $3 billion.

Global Competition, Local Challenges

While significant strides have been made in developing economic zones and high-tech parks, holding road shows, promoting public-private partnerships, country's investment climate, on the global stage, Bangladesh lags behind its South Asian peers.\

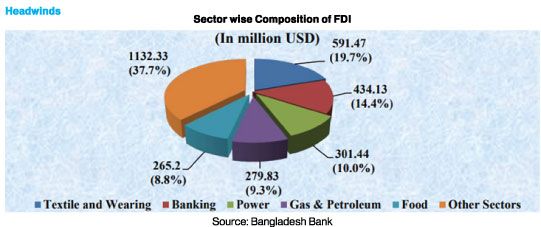

Energy sector has drawn significant capital in recent years, but the plants often did not operate at full capacity as they faced hurdle in generating BDT revenue and sourcing Foreign currency for importing raw materials.

In Infrastructure, Land acquisition has always remained one phase that pushed the project timeline. Companies face challenge in implementing cash free toll collection via electronic and QR code based mechanisms..

Manufacturing contributes 42% of total FDI. One small incident is enough to put the head office at alert and pause all future inflows in the market no matter how big a revenue contributor the local franchise is. They also deal with the 'cancel culture' and "mass boycott' in this era of influencers.

Enough has been written about the Banking sector in recent weeks, reform committees already formed and we can only hope it brings retail investor confidence on bank's ability to protect depositors' money.

Emerging Opportunities

Sectors such as agriculture, fisheries, solar power, IT, food export remain underdeveloped yet full of potential. Investors are looking toward these industries as the next frontier for growth in Bangladesh, provided the necessary reforms materialize.

Looking Ahead-Reforms We Recommend in short term

1. The legal and regulatory framework: Pro-investment legal framework with necessary amendments in key regula- tions taking into considerations practical use cases e.g. BIDA Act, FERA, FX Guideline etc., make English version available for BB circulars and circular letters that are relevant for FDI clients, simplified flow chart for project companies to avoid dealing with multiple government agencies

2. Guaranteed protection to investors' money: Ensure timely payments against services and goods delivered by foreign investors, allow seamless repatriation of dividends and home office expenses. Powerful committee can be formed to handle complicated cases to avoid unreasonable delays.

3. Safety & security: Beef up security in major industrial belts to avoid damages to assets and ensure employee safety

4. Labor unrest: Take short term and long-term measures on labor unrest to contain that within acceptable level and avoid future risk of mass unrest in companies outside industrial belt

5. Economic discipline: Bring in appropriate knowledge and experience in place while taking decisions on economic drivers following required elements of free market economy protecting the benefits of mass citizens. e.g. Exchange rate, interest rate, remittance incentive

In Medium term, We can explore creating separate and central investment promotion cell under supervision of BIDA to run effective local and international campaigns highlighting the positive stories to targeted investor class. Run this through professional home-grown agencies and talents who have established track record of working in nation building initiatives. An improvement in the Corruption Perception Index (CPI) will validate the positive narrative.