- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

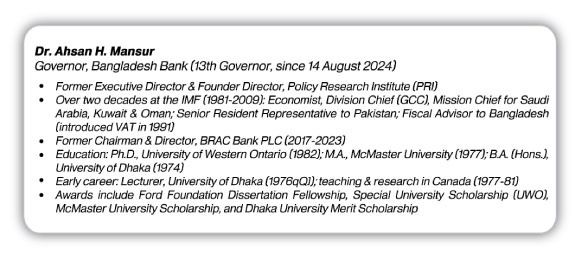

Bangladesh stands at a pivotal stage in its financial journey, despite rapid growth in mobile financial services and digital payment systems, cash still dominates everyday transactions. In this exclusive interview with FICCI, Dr. Ahsan H. Mansur, Governor of Bangladesh Bank, shares his vision for accelerating the shift toward a cashless economy, highlighting strategies to promote digital payments across all segments of society, empower women entrepreneurs and students, address digital literacy gaps, strengthen cybersecurity, and build an inclusive financial ecosystem for both urban and rural populations.

Q1. What specific strategies is Bangladesh Bank implementing to accelerate the transition to a cashless economy? It is your own brainchild and you are always passionate to do that. And how do these align with your vision for financial inclusion across urban and rural populations?

BB Governor: We have an economy that is still largely dependent on cash. Despite significant progress through the introduction of bKash, Nagad, credit cards, and other digital instruments, the demand for cash remains high, still growing at double-digit rates. We haven't seen any tapering off in that growth in demand for cash even if compared with two decades ago. Currently, it's still growing at around 10 percent per annum.

So, despite all the innovations we have introduced like Real Time Gross Settlement (RTGS), digital wallets, and mobile financial services, cash still dominates both the front end and the back end of most transactions. Mobile Financial Services (MFS) like bKash and Nagad handle over Tk. 5,000 crore in transactions daily, but still cash is mostly used both at the beginning and at the end point. Only the middle part of the transaction is cashless. To truly move toward a cashless economy, we must find a solution to eliminate cash at both the front and back ends. Otherwise, if we just put cash in and take cash out, we aren't solving the core issue and not moving towards a cashless economy.

So, how do we tackle this? Essentially, we aim to utilize every available channel for promoting cashless transactions. For example, we are encouraging all banks to upgrade and promote their mobile apps, so customers reduce their need to withdraw and deposit cash at branches or at cash machines. All payments of wages and salaries to be made electronically through bank or MFS accounts. We would also like to push bKash, Nagad, and other players to go beyond just serving salaried individuals and household members. They should also engage with informal sector players such as rickshaw pullers, grocery stores, barbers, bus drivers, and basically every economic agent operating in the economy. These people and their related economic activities need to be brought into the digital ecosystem so that transferred funds can be used directly in further transactions, without reverting to cash.

The "last mile" is where the real challenge lies, and that is where we need to focus. Whether it is our neighborhood grocer, barber, rickshaw-puller, or any service provider we should be able to pay them using a touch card, mobile phone, or MFS account/wallet. We are actively promoting that. We are also exploring more standardized avenues. For instance, we are trying to make it easier for people to get and use payment (credit or debit) cards. Some regulatory barriers have already been removed. For example, you no longer need to submit a tax return to get a credit card. The process should be simple, like if you have an account, you should automatically eligible to have a debit/credit card or both. We also want to increase credit card limits to make their use more convenient.

In addition, we have introduced a regulation requiring every bank branch to adopt a high school and open bank accounts for every student. These students should be given cards or access to mobile apps and taught to operate their finances digitally, not through paper cash or checkbooks. Branch managers and other staff will visit schools, educate the students, and onboard them as clients.

Q2. Are there specific programs or partnerships planned to provide women entrepreneurs with digital financial tools, such as nano-loans or mobile banking, to support their economic empowerment in a cashless ecosystem?

BB Governor: You see, in spite of everything we have done so far, access to finance for women entrepreneurs or female business professionals is still very limited, at just around 4 to 6 percent. That is a very small share. What I am trying to do now is, ask all the banks to ensure that, wherever they appoint agent bankers, at least 50% of them have to be women. Female agents can access homes that male agents often cannot, including areas like kitchens and living rooms, enabling them to digitally onboard women with handheld devices and connect them to formal financial services. Whatever money these women might have been keeping aside or hiding at home, they can now deposit into proper institutions and become part of the formal financial system. We need to actively push this agenda. I know it is not easy. The school debit card mobile app based account opening initiative for students-more than 50% of whom are female--will also support this inclusion effort. Since female enrollment is higher than male enrollment in high schools across the country, a successful school inclusion program will help boost female financial literacy and participation in the financial sector in the long run.

Q3. How is Bangladesh Bank addressing barriers such as digital literacy and infrastructure limitations to ensure equitable financial inclusion in the push for a cashless society?

BB Governor: Digital literacy is obviously a problem. There are two main issues. First one is access issue. If someone does not have access to digital services, then they do not have the opportunity to develop digital literacy in the first place. Second, even when someone has an account, he/she often does not know how to operate it. They may lack the knowledge or confidence to use it properly. Much of the problem with digital transactions stems from this literacy gap. For example, people may unintentionally share their access credentials, perhaps with a nephew, husband, or someone else who then transfers the money, and the original account holder loses control over the funds. That is a frequent occurance and a serious concern.

This is why I believe that if we really want to address these challenges, especially in difficult or sensitive areas we need to work with female agents or operators. Women face many barriers: social, cultural, even religious. They may not feel comfortable going to a bank or formal office of agents to open their accounts. But they want to. They just do not know how, or where to go.

Female agents can bridge that gap. It is more user-friendly and culturally much more acceptable when an woman from the same community-someone known and trusted-perhaps a housewife from the same or neighboring village comes to help. That makes the entire process more approachable and comfortable for all women, particularly in rural areas.

Q4: What role do you see public-private partnerships playing in scaling up cashless transactions, and are there any new initiatives planned to incentivize businesses and individuals to adopt digital payments?

BB Governor: We are considering different ways of doing things. We have conducted an in-depth study in collaboration with Bangladesh Bank and the IFC to identify the key pain points and find effective solutions. That study has just been shared with us, and we have already provided our feedback on it. We now have clear, targeted solutions, particularly for the banking sector.

As for the Public Private Partnership (PPP), I do not expect this to involve government ownership. This initiative is being driven by the private sector. Our role will be in the form of a proactive regulator to ensure a conducive competitive environment, even playing field for all players in the eco-system, uphold system integrity, promote technological upgradation and innovation, strengthen cybersecurity, and facilitate speedy complaint resolution. These are the areas where we aim to focus our efforts. We do not intend to be a direct investor in these initiatives, except in cases where a bank is already government owned. But we do not plan to create new public ownership structures. Instead, our involvement will come through relationship-building, encouragement, and appropriate incentives.

For example, we are working on introducing affordable smartphones, priced below Tk. 10,000. This would involve sacrificing some advanced features, as we do not need all the capabilities of a high-end iPhone in an ordinary basic smart phone. What we need is a basic smartphone that enables internet access, financial transactions, voice calls, and access to platforms like Facebook and YouTube. We are also engaging with mobile operators and banks to enable installment-based payment plans. So, if a device costs Tk. 10,000, it could be paid off over one or two years, in monthly installments of 500 or 1,000 Taka.

I believe smartphone use is no longer a luxury, it is a basic necessity. Therefore, it should be made accessible at affordable prices. I have also been in discussions with the National Board of Revenue (NBR) to explore the possibility of reducing taxes on these devices. These measures are all part of our broader strategy, which will be launched very soon.

Q5. How is Bangladesh Bank balancing the promotion of a cashless economy with regulatory measures to ensure cybersecurity and protect consumers from fraud in digital financial transactions?

BB Governor: Cybersecurity is an area where we face challenges. However, many of these challenges stem not from sophisticated hacking, but from a lack of financial education, as well as social and cultural factors that lead people to share their passwords or sensitive information with others. These behaviors compromise personal security. It is not that our systems are constantly under attack by hackers who successfully breach them, though of course, we must remain vigilant. We do have vulnerabilities, and I do not want to downplay that. In particular, many banks still lack dependable internet banking options along with adequate protection, and Bangladesh Bank need targeted programs to address those gaps.

Cybersecurity, what I would call the "fourth dimension" of the financial system, will continue to be a major and growing challenge. When people lack financial literacy and basic safeguards, they inevitably become more vulnerable to cyber threats and other forms of scams. We hope the government will play its part by incorporating financial literacy into the national school curriculum. At the same time, Bangladesh Bank is trying to supplement this effort by directly enrolling students into the banking system through our extensive bank branch network, given that Bangladesh has the highest density per square kilometers among all countries (except city states). As part of this initiative, students will receive basic financial literacy training, they will learn what to avoid, what not to do, and how to conduct transactions securely. This kind of practical education/training will be part of the ongoing engagements between banks and schools.