- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

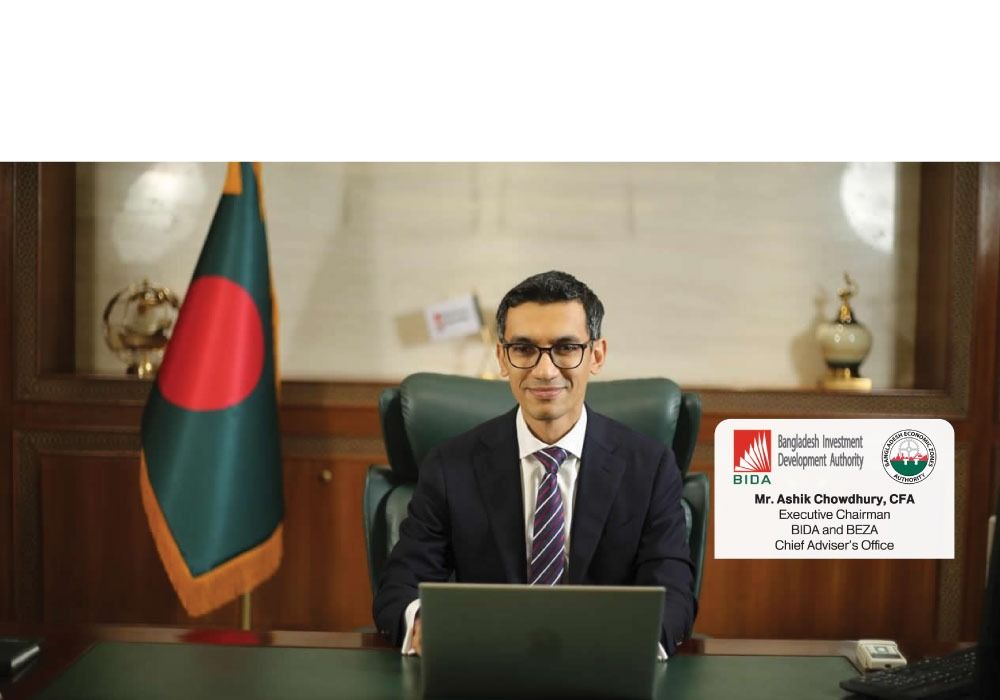

Mr. Ashik Chowdhury, CFA, has recently been appointed as the Executive Chairman of both the Bangladesh Investment Development Authority (BIDA) and the Bangladesh Economic Zones Authority (BEZA). With his extensive experience in finance and investment, Mr. Chowdhury is set to guide BIDA and BEZA towards new horizons. In this exclusive interview, FICCI delves into his vision for BIDA and BEZA, the strategic initiatives he aims to implement, and his insights on the evolving landscape of investment in Bangladesh. This interview explores the thoughts and aspirations of a leader dedicated to driving economic growth and development.

Q1. What are your thoughts about taking charge of BIDA and BEZA as their first Executive Chairman from the private sector? How do you plan to use your expertise for BIDA and BEZA, and what changes can we expect?

It is a great responsibility, but the opportunity to serve Bangladesh is my highest privilege. I am excited to combine reliable public services with the dynamism of the private sector. BIDA and BEZA both have untapped knowledge and resources, and I look forward to putting them to work. We envision to reform our practices by putting our investors at the core of our activities. There is a lot of desire within these organizations to learn and adapt to global best practices and I am very happy to support that. An example would be to adopt a relationship-based model to foster long-term ties between investors and investment promoters. This method helps build credibility, resolve challenges and makes investors more inclined to commit to long-term projects.

Q2. Bangladesh has faced image challenges regarding governance, ease of doing business etc. How do you intend to tackle that?

The support we provide to current investors will shape our global reputation. It has been said before, but now it must be internalized - our investors are our global ambassadors. Our high-growth economy already generates a lot of investment interest. But to materialize these, we need a supportive narrative and standardized facilitation services, which are our key focus. So, my most fundamental approach to improving our global image is to develop a pipeline of success stories - stories of real support, and making sure these are told in the right places by the right people.

Q3. Having had a successful career in finance and investment, what specific strategies will you implement to attract high-quality FDI into Bangladesh, especially in competitive global markets?

Our strategy is to consistently communicate our strengths, be it our vibrant domestic market driven by young consum- ers, growing skills or enabling the infrastructure. Promotional efforts can be shaped through collaboration with existing foreign investors and the cooperation will ensure that we are speaking the language of our global audiences. The goal will be to attract projects that are sustainable, mutually advantageous and resilient to risks. We can target overlooked but high-potential areas like ESG investments. As a climate-vulnerable country, Bangladesh can attract the massive ESG community, while aligning with the Hon'ble Chief Adviser's Three Zero Theory. This can drive real inclusive growth, create new jobs in knowledge-driven sectors like renewable energy, agriculture and healthcare - while contributing to a zero-carbon future.

Q4. What reforms or policy changes do you envision to streamline investment processes and reduce bureaucratic hurdles for both foreign and local investors? How do you think we can create ease of doing things by simplifying the regulatory environment?

One of the things that I was impressed to find is that my offices and the business community already have a reliable assessment of what needs to be done. The challenge lies in execution. Building institutional processes requires strong conviction. We should consider an impact-based reforms model to prioritize the most egregious pain points. The necessary consensus can be achieved by harnessing the country's current reformative mood. The 90, 180, and Beyond Framework will also give clarity to our action plan, ensuring systematic public engagement on progress.

Q5. What long-term outcomes do you hope to achieve during your tenure, and how will you measure success in terms of improving Bangladesh's investment climate and economic growth?

We aspire to emerge as model government offices by the end of my first year. We would then put ourselves on track to become world-class IPAs. It is reassuring to the find that the essential elements of success are already in place. Higher volume and diversity of investments across sectors will indicate strong performance. But most importantly, raising the level of satisfaction and comfort of our existing foreign investors will make them devoted ambassadors of Bangladesh: the most evident marker of our success.

Ashik Chowdhury is the Executive Chairman of the Bangladesh Investment Development Authority (BIDA) and the Bangladesh Economic Zones Authority (BEZA). He holds the rank of Senior Secretary and is the first private sector leader to head these key investment promotion agencies (IPAS) under the Chief Adviser's Office.

Previously, Mr. Chowdhury was an investment banker at HSBC Singapore, specializing in infrastructure and sustainable finance. His expertise spans across advisory, investment strategy, M&A and strategic planning. He began his banking career at the Standard Chartered and headed finance at American Airlines, covering Europe and Asia. He has also advised the Grameen Telecom Trust.

Mr. Chowdhury has an MSc in Finance from the London Business School, where he was awarded an Alumni Scholarship. He got his BBA in Finance and Economics from the Institute of Business Administration at Dhaka University. He has advised the Brunel Business School in London and taught business at Dhaka's Bangladesh University of Professionals as a visiting professor. He is also a Chartered Financial Analyst (CFA).

He is a certified skydiver and holds the Guinness World Record for the longest freefall with a flag. He is also a private pilot licensed in the UK.