- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

Bangladesh is a country with high potential for Foreign Direct Investment (FDI). Strategic location of Bangladesh between the emergent South and Southeast Asian markets and its large workforce have been rewarding for attracting FDI inflows since the inception of economic reform in 1995. With robust growth, strong macroeconomic stability and booming private business, Bangladesh has achieved the outstanding accomplishment of becoming the second largest garments producer in the world.

Bangladesh offers a range of investment incentives under its export-oriented growth strategy and industrial policy aimed at seeking foreign investment. Large investment inflow in electricity, transport, and telecommunications sector is creating a strong foundation for business. Other major sectors of foreign investments include readymade garments and textiles, energy and power, infrastructure, healthcare, ICT, agribusiness, leather and leather goods, electronics, light manufacturing, medical equipment, Pharmaceuticals, and plastic. Alongside these, the agro-processing industry, light engineering, digital financial services, etc. are emerging sectors with high potential to bring in more FDI in the upcoming future.

Although the net FDI inflow in Bangladesh has significantly increased in recent years, the FDI to GDP ratio is still not up to the mark. The low inflow of FDI indicates the need for reforms in policies and regulations to enhance the business environment to gain investor confidence.

Foreign direct investment (FDI) is crucial for Bangladesh at this important stage of national life for economic recovery and sustainable development. Despite abundance of cheap labor and attractive incentives offered by the government of Bangladesh, FDI inflow staggers much behind the essential mark.

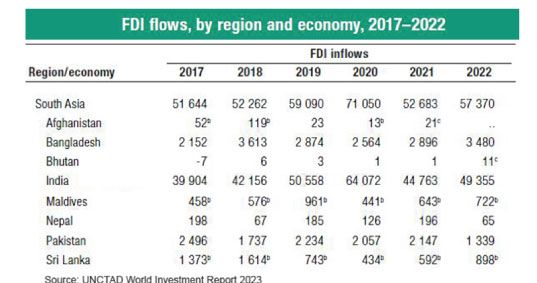

According to the UNCTAD World Investment Report 2023, despite being the second-largest economy in South Asia, Bangladesh ranked fourth in the region in terms of FDI inflow as a percentage of gross domestic product (GDP). FDI inflow accounted for only 0.75 percent of the GDP. Although Maldives received $722 million in FDI in 2022, that accounted for around 11.70 percent of its GDP. Sri Lanka, which suffered a severe economic crisis in 2022, fetched $898 million from foreign investors, which accounted for 1.20 percent of that country's GDP.

In terms of US dollars FDI net inflows of Bangladesh was USD 3.0 billion during the Calendar Year 2023, which was higher than both Maldives and Sri Lanka. But considering FDI as a percentage of GDP, both the countries supersede Bangladesh.

Barriers to FDI

According to Bangladesh Bank (BB) statistics, net FDI Inflows in the calendar year 2023 were USD 3004.40 million, recording a 13.7% decrease from USD 475.55 million in the calendar year 2022. The COVID-19 pandemic and the war in Ukraine made unfavorable impact on Bangladesh economy, as the demand for Readymade Garments (RMG) export declined and energy and food prices rose sharply. Rising commodity prices and high imports in 2023 resulted in a wide balance of payments deficit. Sharp depreciation of Taka against the U.S. dollar over the past two years created volatility which raised concern among foreign investors about currency risk and overall economic environment.

There are more barriers to FDI inflow in the long run, than the temporary economic downturn caused by external factors. Those barriers need to be addressed and minimized through effective reforms in a pragmatic and sustainable manner. Bureaucratic delays, sluggish governance in various sectors, lax enforcement of labor laws and persistence of corruption create an unwelcoming environment for foreign investors, which are critical barriers to attracting FDI.

There  has been plausible and gradual progress in reducing some constraints on investment, such as taking steps to ensure reliable electricity. However energy supply still remains unreliable, which affects production schedules. Bangladesh has achieved commendable infrastructural development, but infrastructure inadequacy still remains a barrier for attracting FDI. Inadequate infrastructure, particularly in transport and energy obstruct operational efficiency. Bangladesh lags behind its competitors in South Asia in developing facilities at the port for handling cargoes and containers, alongside transport and logistic facility, Congestion at the port cause delays leading to increased business cost.

has been plausible and gradual progress in reducing some constraints on investment, such as taking steps to ensure reliable electricity. However energy supply still remains unreliable, which affects production schedules. Bangladesh has achieved commendable infrastructural development, but infrastructure inadequacy still remains a barrier for attracting FDI. Inadequate infrastructure, particularly in transport and energy obstruct operational efficiency. Bangladesh lags behind its competitors in South Asia in developing facilities at the port for handling cargoes and containers, alongside transport and logistic facility, Congestion at the port cause delays leading to increased business cost.

Foreign investors assess facilities before making any investment decision. When investors come to establish some business they come on basis of feasibility study and research, with 10 years business plan. Inconsistency and frequent changes in government investment policies create uncertainty for the investors. Lack of predictability in taxation and regulatory environment make it challenging for investors to go along long term business plan.

Limited sector diversification is also a factor for low inflow of FDI. Heavy reliance on the RMG sector, which accounts for over 86 percent of Bangladesh's export earnings, makes the economy vulnerable to global market fluctuations. Investors increasingly seek opportunities in diversified sectors. Sector diversification has so far been explored in Bangladesh only to a limited extent.

Top 10 Investing Countries

Insufficient (and declining) FDI inflow is a matter of concern for Bangladesh particularly keeping in view the fact that in the region there is substantial inflow of FDI. India attracted over $40 billion and Vietnam $15 billion FDI in 2023.

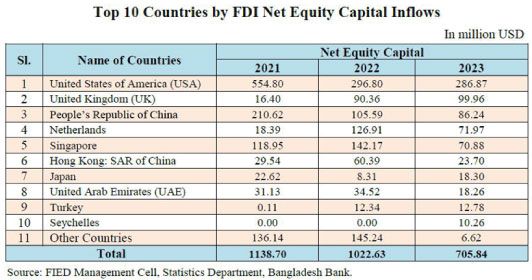

United States of America (USA) and China are the largest investors in Bangladesh. While inflow of FDI from USA to Bangladesh dropped by 11 percent year on year to approximately $315 million in 2023. China reportedly became Bangladesh's largest FDI source country in 2023 on account of gross flow of $940 million.

According to BB data, top ten investing countries accounted for almost 99.06% of the total equity capital inflows to Bangladesh in 2023. Net equity capital inflows in Bangladesh stood at USD 705.84 million, of which highest share of investing countries were United States of America (USA): USD 286.87 million, United Kingdom (UK): USD 99.96 million, People's Republic of China: USD 86.24 million, Netherlands: USD 71.97 million, Singapore: USD 70.88 million and Hong Kong: SAR of China: USD 23.70 million.

Transformative Power of FDI

In the past decades several sectors in Bangladesh, such as Fast Moving Consumer Goods (FMCG) and Information & Communication Technology (ICT) have benefitted from large influx of investments. Transformative power of FDI inflow significantly leveled up technology, skills, and overall management standard of the industries. RMG, Telecommunications and Energy are the sectors assimilating the highest transformative benefits of FDI.

FDI has played an indispensable role in propelling the RMG sector to its current position of second top garments producer in the world. According to the FY2023-24 export figures of the National Board of Revenue (NBR), Youngone Corporation owned by South Korea's Kihak Sung topped the list of readymade garment exporters from Bangladesh. Youngone Group first reached near to a billion dollars in exports in FY2022-23 by exporting readymade garments worth USD 985.3 million. Youngone exported 34.5 million pieces of readymade garments to 52 countries in the last fiscal year.

Youngone Group exports high-end garments from Bangladesh. Youngone initiated operations in Bangladesh in 1980. The first private sector export processing zone, Korean Export Processing Zone (KEPZ) was launched in Bangladesh in May 1996 in industrial area in Chattogram. KEPZ houses a mix of eco-friendly factories, protected green areas and wetlands. Presently Youngone has 42 state-of-the-art green factories in operation. Youngone operation worldwide has industrial set-up in Korea, China, Vietnam, India, Switzerland, Uzbekistan, Ethiopia and El Salvador.

Investment Promotion Authorities

Four investment promotion agencies were given the responsibility for attracting foreign investments by the govern- ment of Bangladesh through the One Stop Service Act 2018. The agencies are: Bangladesh Investment Development Authority (BIDA), Bangladesh Export Processing Zone Authority (BEPZA), Bangladesh Economic Zones Authority (BEZA), and Bangladesh Hi-Tech Park Authority (BHTPA).

BIDA is responsible for screening, reviewing, and approving investments, but BEPZA, BEZA, or BHTPA may also become involved if the foreign investment takes place in an export process- ing zone, economic zone, or high-tech park. Moreover, all compa- nies must obtain approval from relevant ministries and agencies with regulatory oversight.

A country like Bangladesh cannot afford to have so many different investment promotion authorities, which rather complicate invest- ment procedures unnecessarily instead of facilitating investment. Through effective reform, we need to empower a single apex authority to facilitate all licensing and other applicable authoriza- tion required by investors to initiate their business projects. Responsibilities of all other relevant domain authorities should be structured so that all the formal procedures can be completed

through a single window, a one-stop service of the apex investment promotion authority which can play a key role as BIDA.

As per BB data, major inflows of FDI are located in Non-EPZ areas. Equity capital, Reinvested earnings and Intra-com- pany loans located at EPZ areas accounted for 13.0% (USD 390.81 million) of net FDI inflows of USD 3004.4 million. And inflows located in EZ areas accounted for 0.3% (USD 8.92 million). As against that, FDI located in the Non-EPZ areas accounted for 86.7% (USD 2604.67 million) of total net FDI inflows. However, FDI Inflows in the Non-EPZ areas witnessed a decrease of 15.27% in the year 2023 compared to 2022.

Creating a Country Brand

To attract foreign investors as well as visitors it is important to identify how Bangladesh is perceived by the outside world and international public. Aim of such survey and research-based identification is to find ways out to project the right image that would reflect actual potentials and prospects of Bangladesh, particularly for prospective foreign investors.

Creating a rewarding brand for the nation requires an overall comprehensive and integrated strategy. Country Branding is not a function that could be performed separately by the state, state bodies or any other association. Effective country branding requires integrated and concentrated effort of all stakeholders.

Some initiatives have already been taken in recent years to brand Bangladesh. But those initiatives have created little effective results, as those initiatives have mostly been private and sporadic. Even among the government bodies there is a lack of coordination and integration in projecting the image of Bangladesh. For example, the tagline presently being used by the Export Promotion Bureau (EPB) is: 'We Promote Export, We build Smart Bangladesh. Whereas, the tagline used by the Bangladesh Investment Development Authority (BIDA) is: Welcome to Bangladesh, the Rising Star of Asia'.

Some initiatives have already been taken in recent years to brand Bangladesh. But those initiatives have created little effective results, as those initiatives have mostly been private and sporadic. Even among the government bodies there is a lack of coordination and integration in projecting the image of Bangladesh. For example, the tagline presently being used by the Export Promotion Bureau (EPB) is: 'We Promote Export, We build Smart Bangladesh. Whereas, the tagline used by the Bangladesh Investment Development Authority (BIDA) is: Welcome to Bangladesh, the Rising Star of Asia'.

A review at a glance of the "Incredible! India" campaign would make it clear, how a country branding initiative must to conceive its scope and aim of project the right image. The Indian Government's National Tourism Policy (NTP) 2002 can be seen as having sowed the very seed that sprouted the idea of Incredible! India. This is obvious as the NTP 2002 states that, "In the international market, India requires a positioning statement that captures the essence of its tourism product to convey an "image" of the product to a potential customer and which will become the India 'Brand'. Motivation for India Brand came from already famous branding exercises undertaken by some of the world famous tourist destinations such as 'Amazing Thailand', 'Malaysia, Truly Asia', The Philippine's Festival Islands' and Egypt's 'The Land of the Pharos'.

In today's globalized economy, creating a successful country brand is integral part of investment promotion for gaining unique global visibility focused on actual potentials to stimulate investor's curiosity, trust and confidence. It is also noteworthy that the Maldives and Sri Lanka have prepared their policy focusing on specific areas and formulating effective laws for safeguarding FDI and repatriation of profit. Maldives has focused on the tourism sector while Sri Lanka focuses on tourism, agriculture, and information technology.

Projecting the right country image represents the result of an integrated effort in the long term, which requires consis- tent and stable marketing strategies. Our crisis is we lack in coherent internal assessment practice. The Government should have an autonomous research unit where facts and experience of all the stakeholders can be shared, pooled and analyzed with regular exercise of periodic assessment and updates.

Essential Reform for Gaining Investor Confidence

Investment Climate and Business Environment are integral component of creating and maintaining the right image for attracting FDI. A number of strategic initiatives need to be implemented to improving overall investment climate and business environment.

Investment Climate and Business Environment are integral component of creating and maintaining the right image for attracting FDI. A number of strategic initiatives need to be implemented to improving overall investment climate and business environment.

The first and foremost step should be the streamlining of the regulatory framework by simplifying bureaucratic processes and making BIDA's one-stop service for foreign investors fully functional through automation and integrated streamlining. Registration process, regulatory services and all the related services of BIDA, BEPZA, BEZA, and BHTPA should be integrated through automation and monitoring under a single One Stop facility. This will significantly reduce time and effort required to set up business operations.

For improving investment climate Customs Duty, VAT Policies and Corporate Tax rate need to be revised. Intricacies of customs procedures, tariff classifications and valuation methods are cumbersome and daunting for international business. In India, Vietnam, and Thailand, there are no VAT requirements for setting up industries in the economic zone; but in Bangladesh 15% VAT is applicable for such industries.

Effective reform is essential to curb corruption and strengthen governance and monitoring to build up investor confidence. Implementation of e-governance to the full extent would enhance accountability and transparency. Implementation of clear anti-corruption measures is imperative for gaining investors' trust.

Bangladesh is a member of the World Intellectual Property Organization (WIPO) and joined the Paris Convention on Intellectual Property. But intellectual property rights (IPR) protection in Bangladesh lacks prioritisation and investment. The government made some progress to bring IPR legislation into compliance with the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS). However, implementation is slack and law enforcement agencies most often lack the training and resources to pay deserved attention to IPR complaints.

Bangladesh is a member of the World Intellectual Property Organization (WIPO) and joined the Paris Convention on Intellectual Property. But intellectual property rights (IPR) protection in Bangladesh lacks prioritisation and investment. The government made some progress to bring IPR legislation into compliance with the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS). However, implementation is slack and law enforcement agencies most often lack the training and resources to pay deserved attention to IPR complaints.

Investment in infrastructure projects, particularly in energy and transportation is crucial for enhancing investment climate. Public Private Partnership (PPP) for infrastructure development can open up fund sources for those projects. When necessary infrastructure facilities are in place these will enhance business growth and support foreign investments. Implementation of maiden the Logistics Policy of Bangladesh asks for intensive stakeholder engagements and partnerships.

Beyond all, creating a stable economic environment is vital for boosting up investor confidence. This includes managing inflation, ensuring a stable exchange rate, and maintaining healthy foreign currency reserves, all of which will encourage foreign investors to commit to long-term investments in Bangladesh.

Beyond all, creating a stable economic environment is vital for boosting up investor confidence. This includes managing inflation, ensuring a stable exchange rate, and maintaining healthy foreign currency reserves, all of which will encourage foreign investors to commit to long-term investments in Bangladesh.