- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

1. Success of the Ready-Made Garments (RMG) Sector of Bangladesh and the Contribution of Foreign Direct Investment (FDI)

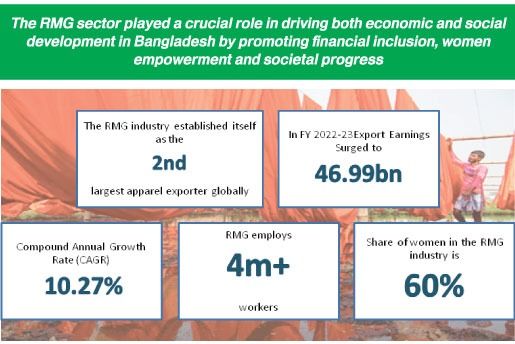

The Ready-Made Garments (RMG) sector of Bangladesh has come a long way. Over the last few decades, the RMG sector has established itself as the second-largest apparel exporter globally, thriving in the low-value market segment, with export earnings surging to an impressive USD 46.99 billion in FY 2022-23. This success is reflected in the compound annual growth rate (CAGR) of 10.27%, accentuating the sector's resilience and ability to compete internationally. Additionally, the industry directly employs more than four million workers, with women comprising approximately 60% of this workforce which demonstrates the sector's critical contribution in driving both financial inclusion and societal progress.

The synergy between local efforts and foreign investment is the reason behind the sector's remarkable achieve- ments and its ability to adapt and thrive in an ever-evolving global landscape. Beginning with the Desh Garments joint venture with Korea's Daewoo Corporation, FDI has been pivotal to Bangladesh's RMG growth. A $1.3 million investment introduced advanced technology, marketing strategies, and training for 130 workers, many of whom later established factories, spurring rapid expansion. Today, RMG exports account for over 80% of the country's total earnings, demonstrating the perpetual impact of this collaboration and the industry's resilience through the global COVID-19 pandemic.

2. Key Transitions Shaping the Future of Bangladesh's RMG Sector: GSP, Automation, and Circularity

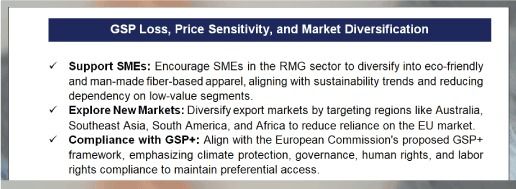

Future direction of this sector points towards three crucial transitions, presenting both opportunities and challenges. The first is the phase-out of the Generalized System of Preferences (GSP) by 2029, marking the end of preferential trade benefits because of its transition out of Least Developed Country (LDC) status in 2026. This change will raise export costs to key markets like the European Union, potentially diminishing the sector's competitiveness. The second transition is the rapid advancement of automation, offering a significant opportunity for enhanced efficiency. However, with only 15 percent of RMG operations currently mechanized, there remains substantial room for improvement, and the sector must adapt quickly to keep pace with global industry trends.

The third transition involves the imperative of embracing circularity, with global markets increasingly demanding sustainable practices and improved working conditions. This shift requires the sector to invest in environmental upgrades and labor rights enhancements to stay competitive. Additionally, rising labor costs and growing competition from other low-cost manufacturing countries will further challenge the sector's growth. With the global markets placing a stronger emphasis on improved working conditions and sustainable practices, the country will require substantial upgrades.

3. GSP Loss May Adversely Impact Trade and Increase Price Sensitivity

The RMG sector's over-reliance on exports to the European Union (EU) exposes it to numerous threats, especially with upcoming changes in trade policies, such as the loss of Generalized System of Preferences (GSP), new EU regulations like the Carbon Border Adjustment Mechanism (CBAM), due diligence laws, and the EU Green Deal's sustainability requirements. Currently, the EU accounts for about 50% of the sector's total exports, making it highly vulnerable to fluctuations in the market.

The GSP currently allows Bangladesh RMG exports to enter the EU market without tariffs. However, the removal of these privileges would make RMG products more expensive due to the imposition of tariffs. This increase in costs could make Bangladeshi products less competitive, especially in the low-value segment where price sensitivity is high. Even minor price changes in this sector could lead to a significant loss of orders, highlighting the potential challenges the sector could face without GSP benefits. Such price increases may cause price disparities and erode the industry's ability to compete effectively in the market. This potential vulnerability requires exploration of new markets, diversification of products, investment in sustainability, improvement of worker conditions, and strengthening trade agreements to maintain its competitive edge.

4. The Risk of Job Displacement from Automation in RMG Can Be Offset by Enhancing Workforce Skills while Boosting Efficiency

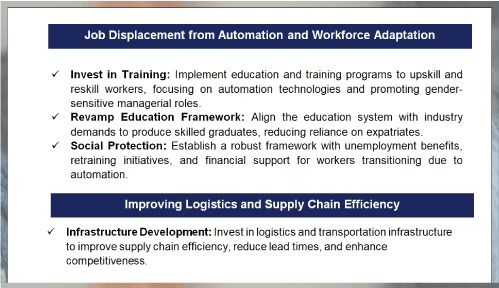

The integration of automation in Bangladesh's Ready-Made Garment (RMG) industry presents a mix of challeng- es and opportunities. One of the primary concerns is the potential displacement of workers, especially as automation replaces certain tasks. This could lead to a substantial shift in employment patterns, with an estimated 60 percent of garment workers at risk of losing their jobs by 2030. This shift also threatens to diminish workers' bargaining power, with women workers potentially bearing the weight of the impact.

Despite these challenges, automation holds the promise of increased productivity and efficiency, shortening production cycles and enhancing overall output. However, this may not necessarily translate into higher wages or improved job security for workers, particularly women, who remain at high risk of losing their jobs.

In response to these threats, the RMG sector can capitalize on the opportunity to invest in skill development and training to ensure workers are equipped to operate and maintain automated systems. This would help mitigate unemployment risks by preparing the workforce for emerging roles, particularly in the service sector. While automation may reduce the number of jobs, it can also lead to higher-quality roles, offering safer working conditions and more specialized positions. Furthermore, enhanced efficiency through automation can result in greater profitability for businesses, potentially improving wages and job stability for workers if these gains are shared. Finally, automation provides an avenue for economic diversification, encouraging the RMG sector to explore higher-value industries such as pharmaceuticals and electronics, creating new employment opportunities and expanding the country's export base.

5. Barriers Remain in Implementation of Circular Economy Despite Numerous Benefits

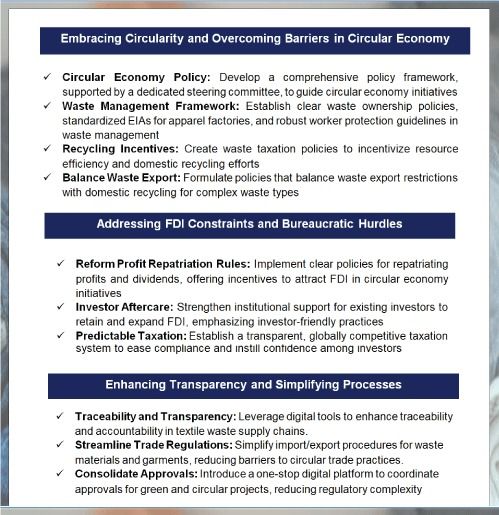

Bangladesh is making progress in environmental protection, but significant hurdles remain in fully adopting circular economy principles. Key challenges include limited capacity for urban landfills, inadequate hazardous waste disposal infrastructure, and the absence of robust incentives and guidelines to promote cleaner production and effective municipal waste management. Moreover, factory compliance monitoring and policy enforcement are areas that require substantial improvement. Despite these obstacles, embracing circular economy principles is essential for ensuring long-term sustainability, optimizing resource use, and addressing the rising concerns about global waste management.

6.The Transition to Circularity Presents Significant Benefits, but Bangladesh Must Overcome Key Challenges to Realize the Benefits

Circularity offers considerable opportunities for Bangladesh to reduce waste generation and enhance resource efficiency. By integrating circular economy practices, the country can shift towards a more sustainable and resource-efficient economic model, fostering long-term resilience. This transition could also help minimize environmental impacts and encourage responsible resource management, ensuring that the nation remains stable and sustainable in the face of global challenges. However, to fully realize the potential of circularity, Bangladesh must overcome several hurdles. These include the lack of incentives for cleaner production methods, insufficient hazardous waste disposal facilities, and the absence of clear guidelines for managing municipal waste. Addressing these challenges will be crucial for the successful implementation of circular economy practices and the country's transition to a more sustainable economic future.

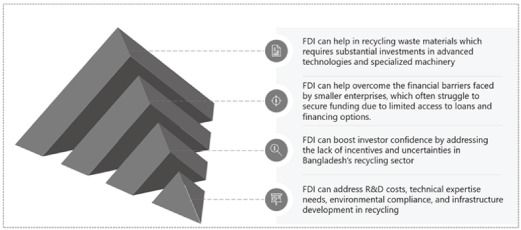

7. FDI Remains Paramount for Circular Economy Transition: Important to Overcome Bureaucratic Hurdles to Attract FDI

Going forward, the importance of Foreign Direct Investment (FDI) will remain paramount in addressing these challenges by offering both the financial resources and cutting-edge technology and driving Bangladesh's circular economy, especially in recycling waste materials. Recycling waste materials requires substantial invest- ments in advanced technologies and specialized machinery, making it a highly capital-intensive industry. The financial barrier is particularly challenging for smaller enterprises, which often struggle to secure funding due to limited access to loans and financing options. The lack of incentives for adopting circular practices, combined with informality and uncertainties surrounding returns on investment, further undermines investor confidence in Bangladesh's recycling sector.

Additionally, high research and development (R&D) costs for non-cotton materials, such as synthetic fibers and blended fabrics, coupled with the need for technical expertise to operate and maintain advanced machinery, pose significant hurdles. Compliance with stringent environmental standards and the development of supporting infrastructure, such as waste transportation and storage facilities, require further investments. For instance, Jinnat Knitwears Limited, part of DBL Group, invested $2.4 million under the IFC-led Partnership for Cleaner Textile initiative to adopt cleaner energy and recycling technologies, reducing resource consumption and promoting sustainability. However, the absence of standardized criteria for evaluating sustainable investments and approaches continues to hinder progress.

However, restrictions and the conservative mindset within the bureaucracy surrounding profit repatriation act as a significant deterrent to FDI inflows. Regulatory authorities impose frequent barriers on profit repatriation, which further hinder the smooth flow of FDI, creating challenges for investors. Foreign investors face difficulties in accessing earnings and dividends, whereas neighboring countries such as India, Vietnam, and Indonesia have streamlined their investment regulations to create a more attractive environment for FDI. Bangladesh would greatly benefit from adopting similar strategies to enhance its investment appeal and foster long-term economic growth, which will help transit to a circular economy as well.