- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

Bangladesh has seen notable progress in the adoption of its digital economy. Consistent and cooperative innovation has propelled the country's multi-sectoral growth in the last few decades. Starting with agricultural mechanization and megastructures, all the way to finance, investment, and digitalization, the nation is now at the crossroads of a thriving digital future.

The vibrant demographic landscape and its potential can open new horizons for socioeconomic change. Nearly half of the population is relatively younger than 25. Additionally, the rising middle class-more than a fifth, or about 34 million of the country's total population-could potentially be early adopters of new technologies like digital services. It is already evident that digital services are becoming integral to consumers in specific spending categories.

Post-pandemic consumer spending patterns indicate a notable shift, with groceries and electronics maintaining the strongest engagement in digital channels. In Bangladesh, consumers have increased their share of wallet on essential goods compared to pre-pandemic levels, influenced by rising costs of necessities, which have reduced discretionary spending.

However, it is not all rainbows and sunshine. Mastercard Economic Intelligence (MEI) has projected that the country's GDP growth is set to decline to 5.7%, with inflation expected to rise to 9.8% in FY24 before easing to 8% in FY25.

Moreover, the country faces several key challenges in attracting and sustaining digital investments. These include the absence of a unified, one-stop solution for investors, which complicates navigation through processes. The pervasive influence of bureaucracy, or "red tape," at various levels-such as customs, ports, and ministries also delays and complicates investment initiatives. Inadequate internet infrastructure further hampers efficiency, and the country suffers from insufficient physical infrastructure overall. Additionally, the lack of clear, facilitative policies and attractive incentives to encourage investment dampens enthusiasm for long-term commitments from both local and international investors.

The inflation uptick has been diminishing consumers' purchasing power, compounding the economic challenges posed by subdued domestic and external demand. Furthermore, elevated US dollar rates could increase vulnerabilities in the external sector. MEI has recommended a transition toward more market-based rates to help address these concerns. Considering these challenges, the solution lies in a more cohesive vision for inclusive growth and innovation.

Building Trust and Incentives for a Thriving Digital Ecosystem

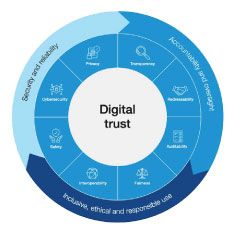

Evolving spending patterns suggest that consumer transactions are increasingly influenced by the availability of modern and innovative payment gateways. With supportive policies, sectors such as e-commerce, cashless payments, mobile financial services (MFS), and credit/debit/prepaid cards have the potential to experience further growth.

To continue this momentum and build a robust economy, the need of the hour is to bring micro, small, and medium enterprises (MSMEs) into the digital ecosystem. Integrating a new batch of merchants into the cashless revolution will drive greater penetration of the cashless economy. If MSMEs gain convenience and a competitive advantage, they can overcome their reluctance to adopt digital tools.

Building trust in digital gateways is crucial in this case. This trust can be gradually achieved through timely innovations. For example, Mastercard initiated the launch of BanglaQR with Bangladesh Bank for small and medium merchants to address such challenges.

Building trust in digital gateways is crucial in this case. This trust can be gradually achieved through timely innovations. For example, Mastercard initiated the launch of BanglaQR with Bangladesh Bank for small and medium merchants to address such challenges.

The recent nationwide digital blackout reiterates the importance of gaining public trust in digital gateways. The blackout led to a substantial 40% decline in digital transactions between July and August. This alone shows how the economy thrives on digital tools and how their absence can jeopardize growth.

It is essential to introduce market-friendly incentive schemes that support the growth of digital adoption. Incentives would not only boost transaction volumes but also enhance a secure and transpar- ent environment. Speculation regarding the removal of the 2.5% remittance incentive has become a concern for the industry. At a time when remittance reserves are rising after a dull period, such incentives could be a breath of fresh air for the industry. Encouraging the flow of USD, these incentives will be a defining factor.

Card usage is on the rise, thanks to the growing consumer class in Bangladesh and merchants ready to adopt cashless gateways. However, the lack of flexible tax paperwork is one of the key hindrances to the growth of digital transactions. While the country has an estimated 8.5 million TIN holders, only over four million are currently paying taxes. This clearly shows that the mandatory tax return to avail a credit card is preventing the growth of this medium. A more flexible approach to making credit card ownership more accessible could generate long-term benefits by expanding opportunities for cashless transactions.

Policymakers should also undertake initiatives to create a conducive investment environment for the digital economy. Regulators need to develop facilitative policies to support the ecosystem.

For Bangladesh to maintain its trajectory toward becoming a digital-first economy, continued and increased invest- ment in digital adoption is imperative. It's not just about technology; it's about creating an environment where workers, employers, and stakeholders can collaborate to achieve a shared vision. If industry leaders and the government work hand in hand as a team, distant dreams will soon become reality.

Bangladesh is on the cusp of a digital revolution, and the investments we make today will define our success tomorrow. The digital economy is more than just an avenue for financial gain; it is a path toward a more inclusive, efficient, and prosperous nation. As Mastercard continues to invest in and support the digital infrastructure of Bangladesh, we are optimistic about the future and committed to playing a pivotal role in the country's digital transformation journey.

Finally, positive branding of the country and its ability to develop state-of-the-art solutions will help bring more investment into the digital economy, further boosting the nation's GDP.