- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

Bangladesh's financial sector is advancing rapidly in digitization, unveiling a robust digital infrastructure and innovative products. This development enables millions to access financial services while enhancing service delivery efficiency. In a remarkable stride toward modernization, the sector is undergoing a digital transformation aiming to enhance financial inclusivity, streamline services, and propel the nation into a digital future.

Bangladesh Bank (BB) is playing a pivotal role in promoting a digital society by embracing fintech and digital solutions to achieve Sustainable Development Goals (SDGs) and the National Financial Inclusion Strategy (NFIS). BB is address- ing the challenges of the Fourth Industrial Revolution (4IR) by reconsidering traditional banking models. It has allowed banks to offer alternative delivery channels, such as Mobile Financial Services (MFS), QR based payment and e-wallets to improve financial access for marginalized populations.

BB acknowledges the importance of digital platforms in enhancing the efficiency of financial product delivery aiming Financial Inclusion, Collaboration with Fin-techs, Regulatory Support, and Smart Bangladesh Initiative.

With that aim, Bangladesh is experiencing a rapid rise in financial inclusion, driven by the swift adoption of digital technology. The digitization of financial services has significantly transformed access to finance, proving crucial for fostering a more inclusive economic recovery in the country. The Central bank played a vital role by guiding and encouraging banks to set a goal of reaching Digital Bangladesh and offered Retail as well as Corporate products such as self-onboarding to accounts through DKYC, secured online banking, system-based loan processing, Nano loans that help Micro Financing, Cash Management to support corporate client's instant need to receipts and payments, ensuring goods mobility to keep balance of supply and demand offering supply chain management system, Faster payments processing by integrating client ERP made entities capable of contributing greater growth of the economy.

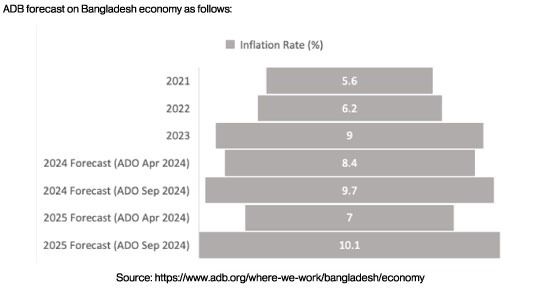

ADB forecast on Bangladesh economy as follows:

By making strategic investments, leveraging innovative platforms, and implementing sustainable growth strategies, Commercial Bank of Ceylon seeks to create value for its customers, stakeholders, and communities by providing tailored solutions, establishing itself as a prominent regional bank in the future leaving a hallmark in the foreign banking cluster in Bangladesh. Despite having the focus in wholesale banking for a considerable period of time, the bank has vision in penetrating to the other segments through the digital technology, CBC developed strategies to leverage technology towards a sustainable growth aiming green financing and enhance financial inclusion through investments in competitive digital platforms like ComBank Digital, a flagship platform that facilitate both Retail and wholesale payments, ePassbook, Card payments, accessible on various operating systems, eExchange facilitating instant remittances to other bank as well as MFS. The bank has undertaken many projects to introduce Q+ payment app, a wallet solution which will serve merchant payments along with QR to provide greater customer experience, ERP integration to support large corporates and SME clients to meet their daily funding needs, streamlining the loan processing system to reduce the turnaround time, Nano loans, Distributor financing to improve the system efficiencies and to provide much needed liquidity to the FMCGs. The bank also is aiming in establishing integrations with government agencies and other stakeholders to offer a pivotal infrastructure that will revolutionize the payment and receipt of the clients ultimately contributing in the economic growth in Bangladesh. CBC already achieved remarkable response by making a growth from 1 billion BDT to 16 billion BDT in digital payment processing through internet banking.

CBC has established clear incident response strategies to identify through its 24/7 online monitoring cell established in Colombo, Sri Lanka, and recover from security threats. Our disaster recovery plans are to ensure that business operations continue during a cyber-attack or other emergencies for a smooth operation and service. Adhering to regulations such as PCI DSS and ISO certifications enables our bank to uphold a strong security standard.

Additionally, we have taken initiatives to collaborate with fintech firms via an Open Banking Platform to harness innova- tive solutions. In line with the Fourth Industrial Revolution (4IR), we aim to integrate cloud technologies, increase the use of robotic process automation (RPA), and develop an Al-driven loan approval system.

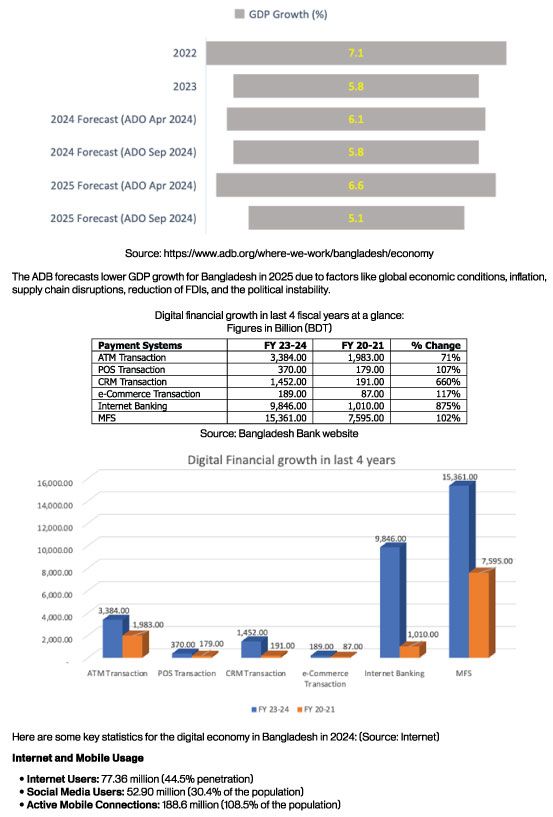

The digital economy is transforming Bangladesh's financial sector, presenting both immense opportunities and significant challenges. While there is substantial progress in digitization, significant hurdles remain, particularly in cybersecurity and digital literacy. Addressing these challenges is crucial in realizing the full potential of the digital economy in Bangladesh.