- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

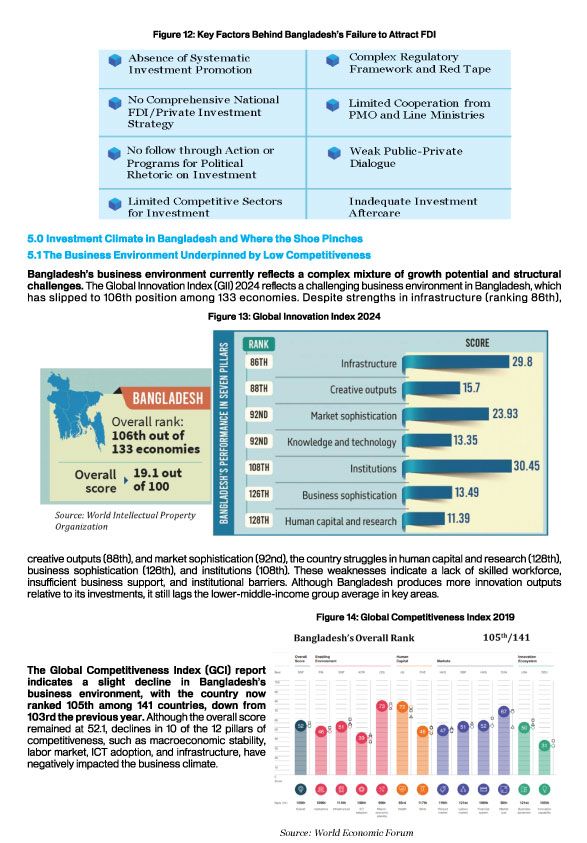

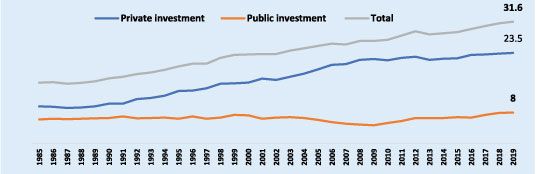

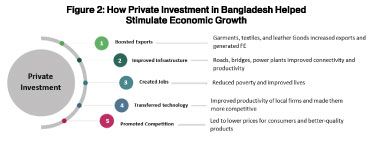

Private investment has been instrumental in driving Bangladesh's transformation from an agrarian economy to a modern and diversified one. Over the past five decades, private capital has constituted 76% of total investment, playing a pivotal role in the country's growth trajectory.

Bangladesh's private sector has evolved through distinct phases. The "Private Sector 1.0" era in the 1980s and 1990s saw agriculture productivity and remittances drive economic growth, while the ready-made garment (RMG) industry emerged as a key player in manufacturing, employment, and service sectors. This phase laid the foundation for rural renewal, food security, and an expanding economy.

Figure 1: Bangladesh's Private and Public Investment, 1985-2019 (% of GDP)

Source: Policy Exchange Database

The acceleration of private sector growth has been significantly aided by trade liberalization. Bangladesh made the shift from protectionist policies to a more open and liberalized trade regime during the 1970s and 1990s. This change involved the abolition of trade-related barriers, the lowering of tariffs, and the deconstruction of import licens- ing processes.

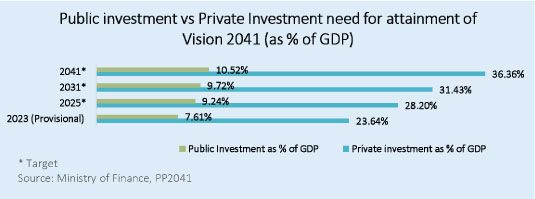

Bangladesh's future economic  prosperity depends on private investment; Sustained investment will boost global competitiveness, innovation, and diversification while promoting the creation of jobs and the fight against poverty, assisting in the goal of achieving full employ- ment and the abolition of extreme poverty by 2031

prosperity depends on private investment; Sustained investment will boost global competitiveness, innovation, and diversification while promoting the creation of jobs and the fight against poverty, assisting in the goal of achieving full employ- ment and the abolition of extreme poverty by 2031

2.0 FDI Enabled Several Important Growth Success Factors

FDI has helped to establish Bangladesh as a global player in the  RMG sector, accounting for approximately 84.58% of total exports in 20234. The entry of multinational corporations and global investments in the garment industry, particularly from countries like South Korea, China, and Japan, has been instrumental in transforming Bangladesh into one of the world's largest textile and apparel exporters. Besides RMG, sectors like telecommunications have benefitted from FDI, with improving digital connectivity and helping to modernize Bangladesh's economy. However, Bangladesh has yet to achieve its full FDI potential.

RMG sector, accounting for approximately 84.58% of total exports in 20234. The entry of multinational corporations and global investments in the garment industry, particularly from countries like South Korea, China, and Japan, has been instrumental in transforming Bangladesh into one of the world's largest textile and apparel exporters. Besides RMG, sectors like telecommunications have benefitted from FDI, with improving digital connectivity and helping to modernize Bangladesh's economy. However, Bangladesh has yet to achieve its full FDI potential.

Private investment, including FDI, plays a crucial role in driving the growth necessary for Bangladesh to reach its goal of achiev- ing upper-middle-income status. By channeling private capital into vital sectors such as manufacturing, services, technology, and in novation, the country experiences a positive cycle of economic expansion. Foreign Direct Investment (FDI) is vital for future growth as it enhances value creation in Global Value Chains (GVCs) and fosters innovation across industries.

Figure 5: The Perspective Plan Emphasizes on the Criticality of Private Sector for Attainment of Vision 2041

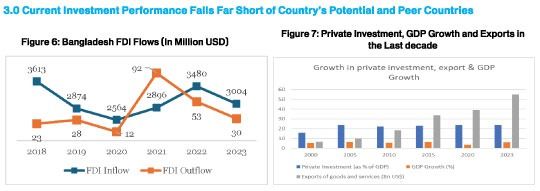

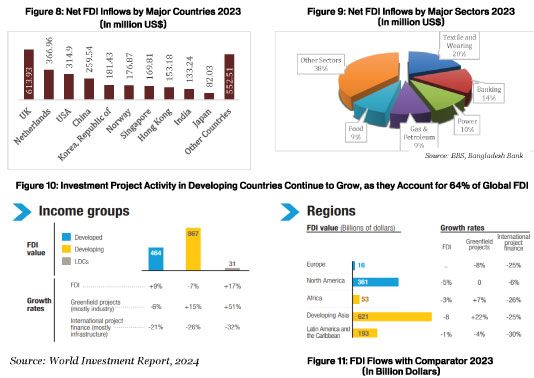

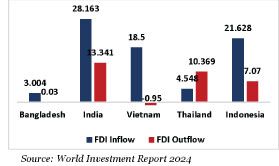

Bangladesh has made notable strides in attracting private investments and FDI,  but it remains modest compared to regional peers like India and Vietnam, which secured $28.16 billion and $18.5 billion, respectively. In contrast, Bangladesh attracted $3.25 billion in FDI in FY 2022-23, a 5.52% decrease from the previous fiscal year. This puts Bangladesh behind countries such as Thailand ($4.55 billion) and Indone- sia ($21.63 billion), underscoring the need for more effective policies and infrastructure improvements to attract foreign capital 5. While Bangladesh is a net recipient of FDI with minimal outflows of $0.03 billion, the country lags its regional competitors in securing substantial foreign investments.

but it remains modest compared to regional peers like India and Vietnam, which secured $28.16 billion and $18.5 billion, respectively. In contrast, Bangladesh attracted $3.25 billion in FDI in FY 2022-23, a 5.52% decrease from the previous fiscal year. This puts Bangladesh behind countries such as Thailand ($4.55 billion) and Indone- sia ($21.63 billion), underscoring the need for more effective policies and infrastructure improvements to attract foreign capital 5. While Bangladesh is a net recipient of FDI with minimal outflows of $0.03 billion, the country lags its regional competitors in securing substantial foreign investments.

Bangladesh's position among the top FDI recipients in Least Developed Countries (LDCs) in 2023 underscores its strategic importance in global investment flows. The country, alongside others like Cambodia and Ethiopia, accounted for about 50% of total FDI to LDCs, emphasizing its role as a key destination for investment aimed at produc- tive capacity and infrastructure development 6. This influx of FDI, particularly in sectors like ready-made garments (RMG), telecommunications, and energy, has been transformative, driving industrial growth and enhancing Bangla- desh's participation in global value chains (GVCs). As FDI continues to flow into these crucial sectors, Bangladesh is poised to further its economic development and integration into the global economy.

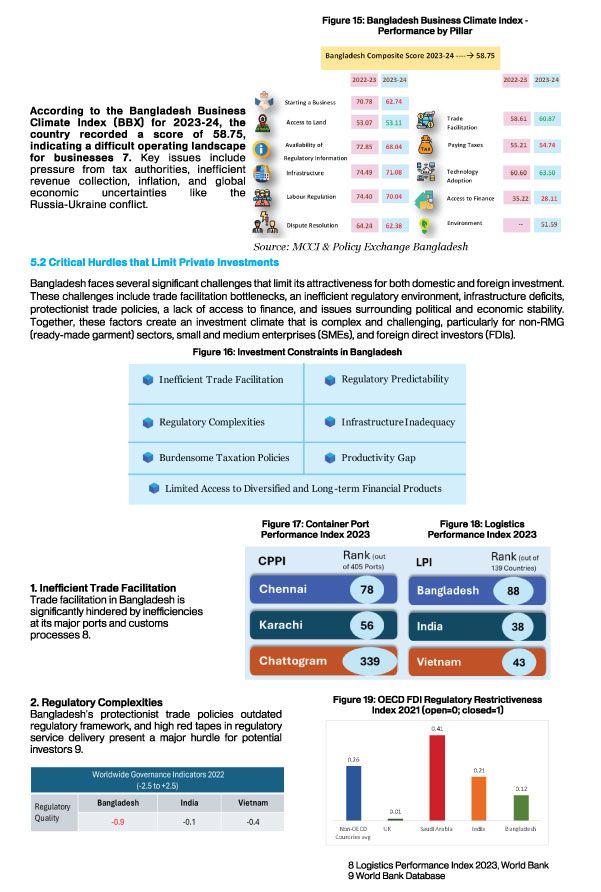

4.0 Why Previous Attempts Failed to Generate Satisfactory Investments Levels

Despite efforts to attract foreign direct investment (FDI) into Bangladesh, previous initiatives have largely fallen short of their goals. A combination of institutional, regulatory, and strategic shortcomings has impeded the country's ability to create a conducive environment for investment. The lack of a unified strategy, bureaucratic obstacles, and limited public-private dialogue have all contributed to these failures. Below are the key reasons why previous attempts have not succeeded in drawing significant FDI into Bangladesh.

5 World Investment Report 2024

6 Asian Development Outlook 2024