- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

01. A Product to Buy vs An Idea to Buy Into

As I took over my role in the Foreign Investor's Chamber of Commerce and Industry (FICCI) earlier this year, many have asked, multiple times regarding the challenges of attracting Foreign Direct Investment (FDI) for Bangladesh. Some even with fervent aggression as to why it even declined, as if it a birthright for the country to receive FDI, forgetting that it is the investors' prerogative where she or he wants to invest given the risk return matrix. The stark reality is that it has not been a recent phenomenon, rather has been a perennial challenge as we have consistently fallen well below our own expectations or even the global benchmarks in attracting FDI.

As a soap seller and as an organization that has a stable of the top brands in the country, I would humbly like to say that we need to start from that perspective of the consumers or customers, or in this case investors, or as a Fast-Moving Consumer Goods (FMCG) marketeer would say, the target audience. Should we put ourselves in the shoes of the target audience (i.e., the potential investors), the 1st thing that comes to one's mind is if we understand their pains or needs. This must start by going under the skin and being empathetic about their investment journey to appreciate why Bangladesh matters to them. Let me break it down by using an example of selling soaps. On the face of it, a soap is a product that our consumers buy, but beyond the product, the consumers also buy into the idea of the brand. That is what differentiates from an average product vs a great brand. Let us now unpeel the skin to understand what makes a great brand. Firstly, the product needs to deliver on the promised functionality. For a soap its about cleaning. All soaps clean so how do we differentiate one for the other? That is where the art and science of building brands come, we must go beyond the functionality and connect at an emotional Illustration So, it will mean that we need to design the product that promises, delivers, and delights consumers or customers (in this case investors) to come back time after time, again and again and see Bangladesh as a preferred investment destination.

the 1st thing that comes to one's mind is if we understand their pains or needs. This must start by going under the skin and being empathetic about their investment journey to appreciate why Bangladesh matters to them. Let me break it down by using an example of selling soaps. On the face of it, a soap is a product that our consumers buy, but beyond the product, the consumers also buy into the idea of the brand. That is what differentiates from an average product vs a great brand. Let us now unpeel the skin to understand what makes a great brand. Firstly, the product needs to deliver on the promised functionality. For a soap its about cleaning. All soaps clean so how do we differentiate one for the other? That is where the art and science of building brands come, we must go beyond the functionality and connect at an emotional Illustration So, it will mean that we need to design the product that promises, delivers, and delights consumers or customers (in this case investors) to come back time after time, again and again and see Bangladesh as a preferred investment destination.

The obvious question is how do we build the muscles to brand Bangladesh. At FICCI we use a 3C framework (Illustration 1: Credibility, Consistency & Capability) to explain this, i.e.,

02. Credibility of Sovereign to Honour Its Commitments

Brands from our very beginnings have led the way on our journey of growth, be it Lux, Lifebuoy, Dove all of these brand worlds had an intuitive sense - a passion, a conviction, a purpose to hardwire brand love into our positioning, by defining each brand as "a product to buy" and "an idea to buy into", with at its core a clear sense of purpose at the service of a specific group of people.

We need to put ourselves in the service of the investors  and understand what aspirations (maybe low-cost reliable supplier, hi-tech solution provider, precision engineer hub etc.) we are solving through our product offering (an investment destination where the investment is secured and profits are easy to repatriate) and how we will serve and connect at a higher level purpose (delivers through sustainable means) to bring it to life. Illustration 2 gives a framework for us to work on.

and understand what aspirations (maybe low-cost reliable supplier, hi-tech solution provider, precision engineer hub etc.) we are solving through our product offering (an investment destination where the investment is secured and profits are easy to repatriate) and how we will serve and connect at a higher level purpose (delivers through sustainable means) to bring it to life. Illustration 2 gives a framework for us to work on.

Here are some specific actions as a nation we need to reimagine ourselves to build credibility:

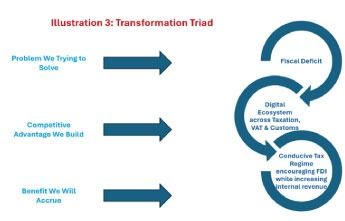

defining how technology will redefine future of work. Our Internal revenue challenges are now setup exactly for a transformation and I believe that we can easily map the workstreams and leverage technology to transform the whole value chain. We can eliminate the intermediaries and decouple the whole value chain to build more revenue for NBR while create a seamless and easy taxation system for the country that can attract and encourage more FDI. Illsutration 3 gives a framework how we can go about in creating a holsitic digital transformation.

defining how technology will redefine future of work. Our Internal revenue challenges are now setup exactly for a transformation and I believe that we can easily map the workstreams and leverage technology to transform the whole value chain. We can eliminate the intermediaries and decouple the whole value chain to build more revenue for NBR while create a seamless and easy taxation system for the country that can attract and encourage more FDI. Illsutration 3 gives a framework how we can go about in creating a holsitic digital transformation.

•Alternate Dispute Resolutions (ADRs), Arbitration & Contractual Obligations, for anyone living up to commitment is nonnegotiable. As an individual I believe if I have made a commitment, I must make good of it, even if meant later one realized that the decision or commitment was erroneous, lest it questions my personal integrity. To me my personal integrity and value system my parents taught is uncompromising. It is no different for a country as well, as a great brand is only built when we have kept up to the promise as a country we have made. We must remember should we have made a contractual obligation, settled issues through ADRs, or have been directed to an arbitration judgement (post all the appeals) we must honour them unless of course we have found concrete evidence of malpractice. There are numerous examples where we have not honoured such commitments or judgements and opted to delay through bureaucratic meandering. Similarly, not making good of dues and payments do not auger well and is seen equivalent to default. We need to remember all these obligations are with the sovereign and it is important to show huge deftness to honour these. We must remember that most entities prefer to settle things out of court, and we must ensure that as a country we setup a mechanism where we have the capability of negotiation and settling things fast that protects the interest of the country, and we are able alienate any opportunity of fraudulence.

03. Consistent Policies & Regulations

Investors do not like uncertainty or instability, and predictability is the name of the game for them. Hence all investors always look at Value at Risk (VAR), a statistic that quantifies the extent of possible financial losses within a firm, portfolio, or position over a specific period. This metric is most commonly used by investment and commercial banks to determine the extent and probabilities of potential losses in their institutional portfolios. This is also now a widespread practice for volatile, high-inflation, high risk markets. Risk managers use VaR to measure and control the level of risk exposure. It is particularly important that we can minimize this and protect share holder value. We need to ensure we design policies that help support this.

Investors do not like uncertainty or instability, and predictability is the name of the game for them. Hence all investors always look at Value at Risk (VAR), a statistic that quantifies the extent of possible financial losses within a firm, portfolio, or position over a specific period. This metric is most commonly used by investment and commercial banks to determine the extent and probabilities of potential losses in their institutional portfolios. This is also now a widespread practice for volatile, high-inflation, high risk markets. Risk managers use VaR to measure and control the level of risk exposure. It is particularly important that we can minimize this and protect share holder value. We need to ensure we design policies that help support this.

• Inter Department Coordination (e.g., BIDA, BEZA, BEPZA, HI Tch Park, NBR, DGDA, BSTI, BFSA, BTRC): We are well known to make an extremely easy thing complicated. We have seen multiple examples when BIDA, Hi-Tech Park Authority or BEZA has agreed on the investment terms which has not been hounoured by other verticals, i.e., NBR. We really need to make it easy for investors to come on board by appointing a national single window for investments where the authority is empowered to facilitate onboarding of the investors and facilitate the process for all permission and licensing. Relevant domain authorities could have their offices but are responsible for the execution through BIDA (or any authority deemed right). BIDA (or any authority deemed right) should intervene with each of the verticals at a policy level should there be contradictions between policies and investment facilitation.

• Dividend, Technical Assistance Fees (TAF), Royalty Repatriation challenges, we must remember all investors need to have their investment protected, hence we need to ensure fast and quick repatriation of all dues and profits. We tend to see the arduous process of paper pushing through bureaucratic maze that ends up making significant delays, many cases years. We need to reimagine this process and find a simpler process whereas an audited financial statement is endorsed by the board for the investors to be able to repatriate the funds.

• Inefficiencies in logistics and infrastructure, a big issue is competitiveness in the logistics. Bangladesh is 33rd amidst the 50 emerging markets in logistics index, a global measure that evaluates the competitiveness of the sector. Logistics is a great enabler for improving competitiveness of the country's investment destination. We have been able to craft a good National Logistics Policy, before reinventing it, I would urge that we focus on the execution plans.

04. Capability of Institutions

At the heart of attracting any investor confidence is to ensure that we eliminate their pain. Any investor that has a free hold resources need to be guided to understand where they can invest with minimal risk. It is important that we map the Investor journey and ensure that we can address their issues and challenges so that the investors are able to seamlessly and frictionlessly invest.

• Investor Onboarding and After Care challenges, all investors need tender loving care. It is one thing to invite guests to your home, but it is a completely different for them to enjoy the hospitality unless one is a great host. Investor retention and ensuring that they become a great ambassador to the country means that we need to ensure that we are there with them on the sidelines to help navigate the regulatory, bureaucratic and compliance issues with ease. It is so important that we formalize this with an Investor on Boarding and After Care Center that can follow through on the specific issues and is empowered to resolve them with speed.

• Lack of depth in our financial sector is a big challenge and on top of it we have vulnerable financial institutions. Ben Bernanke (Economist, Professor, Chair Board of Governors of the Federal Reserve System and Noble Laureate) showed empirical evidence how failing banks played a decisive role in the global depression of the 1930s, reiterating the point bank crises can potentially have catastrophic consequences. We need to reevaluate our end-to-end financial system, given that we have 62 scheduled banks for an economy estimated to be a tad below half a trillion whilst our next-door neighbor India (US$3.5 Trillion GDP) has 34. Trust this illustrates the importance and need for of well-function- ing bank regulation. We need to now define what we will 'fix' and what we will 'accelerate' in the wider financial sectors to reset it for growth.

• Low Workforce Productivity and technology adoption, whilst we boast of having one of the lowest cost labours, the reality is that according to the Asian Productivity Organisation (APO) Productivity Data Book-2024, Bangladesh's labour productivity is 10.4 percent. The average labour productivity in South Asian and the APO countries is 16.3 percent and 27.8 percent, respectively. Much needs to be done here.

• Restriction of Investment Logistics capped, Tourism local partners, State Owned Enterprises (SOE): While we say that we are open for business and welcome investment in all sectors, the reality is that not all sectors are open. Like tourism where one needs to have a local partner and investment is logistics sectors is capped. Many cases we also have SOES running monopolies without a sustainable business model while subsidized by taxpayers' monies. Time is ripe now for the government to divest and secure foreign currency to bridge the fiscal gap.

05. Enough Fish in the Ocean, we Need to Learn how to Fish

Total global FDI is US$ 1.3 Trillion with almost half of it being invested in Asia. Even within the developing countries FDI has increased according to World Investment Report 2024. Our average FDI has been US$ 3 bl (< 0.4% of GDP vs SL at 1.2% and India at 1.5%). The crux of the issue will come to execution and change management. To address the former, we need to chart a clear plan of action, some humble recommendations would be as follows:

a) Do a formal investor journey mapping and identify the pain points

b) Create a scorecard on the reimagination required to remove frictions for investments

c) Form of National Economic Reform Committee & build cadence of review

As for the latter, we need to make people understand the benefit for them should we be able to attract FDI and create a capability development plan for them. Should none of these yield results it would merit refreshing the team.

What we can control is our own performance and our execution, so we need to make sure we are ruthless with this and ensure we are able to create a modicum of change across the system to that transforms and makes Bangladesh the economic brand where the investors become the brand ambassadors.

At the outset, I had said while I sell a product for the consumers to buy, but beyond it is an idea to buy into. We started a journey of change, a journey of reinvention. Now is the time to reinvent ourselves to make people buy into the idea of Bangladesh.