![]() Admin

Admin

![]() September 23, 2025

September 23, 2025

![]() (0) Comment

(0) Comment

![]() Admin

Admin

![]() September 23, 2025

September 23, 2025

![]() (0) Comment

(0) Comment

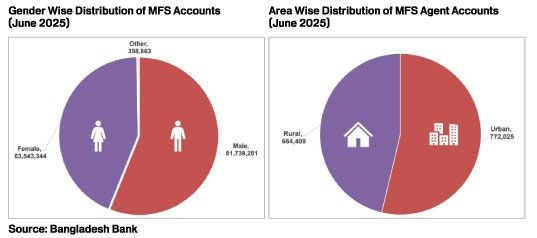

Mobile Financial Services (MFS) has made tremendous progress since its inception in 2011. With almost 24 crore registered customers, around 9 crore remain active as of February, 2025, according to Bangladesh Bank. On the face of it, things look very rosy, but the question remains: can the MFS industry, in the present format, deliver cashless digital economy?

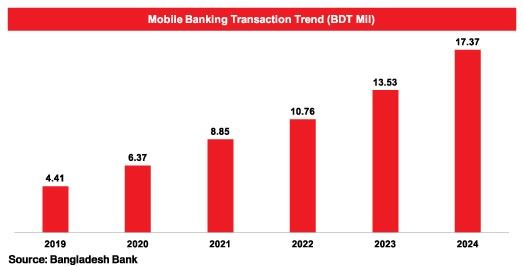

Dr. Debapriya Bhattacharya, distinguished fellow at the Centre for Policy Dialogue (CPD) in his keynote presentation at the Cashless Bangladesh Summit 2025 held recently revealed that MFS transactions reached 17.37 trillion taka in 2024, nearly 50 percent of GDP. Overall, 84 percent of banking transactions are now digital, with 56 percent conducted online and 28 percent via MFS. About 47.8 percent of the population uses MFS wallets, internet banking usage stands at 44 percent, and card usage at 30 percent.

He highlighted critical barriers to a cashless economy in Bangladesh, including 84.9 percent of the workforce operating in the informal sector with low digital literacy and limited banking access.

Speaking at the same event, Bangladesh Bank Governor Ahsan H Mansur said: "The demand for printed money is growing, rising at least 10 percent annually, costing about Tk 20,000 crore per year".

Hence, our vision for cashless economy still has miles to go. Though the MFS industry is beginning to diversify its product and services, the cash in and cash out services still dominate the industry. Hence, the MFS has at best managed to replace the courier service providers.

The seed of limited success was sown long back, when Bangladesh Bank adopted a bank-led model while determining the MFS licensing framework. The licensing framework allowed both banks and non-bank financial institutions (NBFIs) to lead MFS operations.

At one point, the country had 29 licensed MFS operators, which over the years have been reduced to only 13, out of which only three have presence worth mentioning in a market dominated by a market leader.

Let's look at some global examples. Unified Payments Interface (UPI) is a real-time payment system in India that enables instant fund transfers between banks using a smart- phone. UPI is estimated to have over 365 million users in India by end of 2024. The platform processed 172 billion transactions with a value of US$ 2.88 trillion last year.

Let's look at some global examples. Unified Payments Interface (UPI) is a real-time payment system in India that enables instant fund transfers between banks using a smart- phone. UPI is estimated to have over 365 million users in India by end of 2024. The platform processed 172 billion transactions with a value of US$ 2.88 trillion last year.

Within the Brazilian instant payment (IP) ecosystem, Banco Central do Brasil (BCB) created Pix, the Brazilian IP scheme that enables its users to send or receive payment transfers instantly. An estimated 64 billion Pix transactions were processed in 2024. As of December 2024, Pix had over 168 million users, with 153 million individuals and 15 million businesses.

Kenya, being the pioneer in MFS industry, had started off with a mobile led model, but it gradually adopted a hybrid model where other business entities were allowed to offer the service alongside the mobile operators. Kenya's approach to MFS is hence very flexible. With 82.3% of Kenyan households relying on it for transactions, the Kenyan mobile money market reached USD 157.8 billion in 2024.

Therefore, mobile operators offering MFS services around the world is the norm, rather than exception. Let's contextualize it to our local scenario.

Therefore, mobile operators offering MFS services around the world is the norm, rather than exception. Let's contextualize it to our local scenario.

On an average, the mobile operators in Bangladesh invest around 5,000 to 6,000 crore taka every year to improve and expand its country-wide network infrastructure. This sprawling digital infrastructure works as the backbone for not just the telecom but also for the MFS industry, along with other digital service providers.

We need to remember, digital economy is far beyond just having cash-in and cash-out service. In its mature manifestation, digital economy is able to generate insights from the data generated in the digital society to stimulate its growth trajectory.

This requires organizations who are well versed in the domain of data-based insight mining through predictive and generative Al. It needs organizations who can also help the small, medium and large organizations in the private, public and NGO sector to adopt digital technologies to facilitate greater efficiency and sustainable growth.

Traditional banking sector around the world are not known to have these expertise, but for the telecom sector, these are considered bread and butter items due to the very nature of the business model they pursue.

We have already seen how the flexible MFS model is helping India, Brazil and Kenya to advance with their cashless digital economy agenda. In this backdrop, we immediately need to adopt a flexible hybrid approach which does not leave out anyone who wants to and can make a difference to the nation's vision for cashless digital economy.

But for this to happen, we need the Central Bank to shift from just giving away license to collaborative mindset to make sure our policy agenda is implemented team-work; magic wand won't work here.