![]() Admin

Admin

![]() September 25, 2025

September 25, 2025

![]() (0) Comment

(0) Comment

![]() Admin

Admin

![]() September 25, 2025

September 25, 2025

![]() (0) Comment

(0) Comment

From Notes to Numbers: Building a Cashless Future for Bangladesh

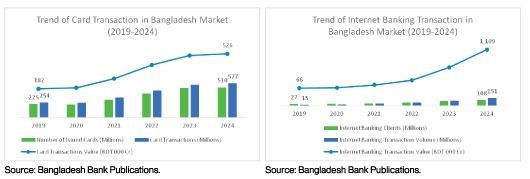

In the past decade, Bangladesh has undergone a steady transformation in the way people live, work and socialise. This has been made possible by the adoption of digital devices and connectivity; a change that is also reshaping the financial landscape. Today, the conversation is no longer about whether digital finance will replace cash; it is about how quickly, seamlessly, and inclusively this shift can happen in Bangladesh.

A media report on 20 July 2025, states that "Bangladesh spends Tk 200 billion yearly on management of cash"1. A truly cashless Bangladesh is not a distant aspiration. It is an achievable goal - one that can empower people, strengthen businesses, and accelerate our journey towards a modern, technology-driven economy. By embracing mobile banking, digital payment systems, and fintech innovations, we are not only making transactions faster and more secure, but also creating unprecedented opportunities for financial inclusion, transparency, and economic participation.

The Power of Digital Banking

At Standard Chartered, we believe banking should adapt to the client's lifecycle, not the other way round. This philosophy drives our commitment to online banking - a cornerstone of our strategy to bring financial services closer to people, wherever they are

From opening a new account to applying for a card, clients can now complete essential banking steps digitally, without stepping into a branch. Everyday needs - whether it's transferring funds to family, paying utility bills, checking balances, or managing cards - can be fulfilled securely and instantly through our online platforms. Our goal has always been to provide our clients with a banking experience that is not just efficient, but also intuitive and secure. We take pride on having a state-of-the-art online banking platform that truly facilitates and simplifies our clients' daily financial lives.

QR Payments: Enabling Seamless Transactions

As part of our mission to deliver innovative, client-focused solutions, we have integrated Bangla QR payments into our SC Mobile app. This feature allows clients to make instant, cashless payments simply by scanning a QR code displayed by the merchant.

The Bangla QR system, developed under the guidance of Bangladesh Bank and facilitated through the National Payment Switch of Bangladesh (NPSB), is a vital step towards a truly interoperable payment ecosystem. It is driving accessibility, speed, and security in everyday transactions-whether it's paying for groceries, dining out, or small business purchases.

Smart Account: A Gateway to Cashless Living

We recognise that to build a cashless society, we must start by making digital finance accessible from day one. Our Smart Account is a savings account designed to introduce clients - particularly those new to formal banking - to the ease of digital transactions. Clients can open an account quickly and start transacting through online channels, without reliance on cash. This helps embed digital habits early and fosters confidence in secure, technology-enabled banking.

Empowering the Digital Workforce through Freelancer Account

The rapid growth of Bangladesh's digital economy is being fuelled by a new generation of independent professionals. Our Freelancer Account responds directly to their needs, offering a convenient account opening process and a seamless way to receive overseas payments securely. Whether working from home, a university campus, or a co-working hub, freelancers can now participate fully in the global economy, without the friction of traditional banking barriers.

By giving freelancers the tools to receive and manage international income easily, we enable them to focus on their skills, their clients, and their growth.

Driving Transparency and Growth

The benefits of moving from cash to digital extend far beyond convenience. Digital transactions leave a transparent record, fostering greater accountability across the economy. They reduce the risks and costs associated with handling cash. This inclusivity strengthens economic participation, enabling a broader base of citizens to engage in commerce, save securely, and access credit.

A Shared Vision for the Future

Bangladesh stands at an inflection point. The infrastructure is in place, the technology is ready, and consumer behaviour is evolving rapidly. The challenge - and the opportunity - now lies in ensuring that this transformation reaches every corner of our society.

At Standard Chartered, we are proud to be part of this journey. From enhancing online banking capabilities, to introducing Bangla QR payments, to launching Smart and Freelancer accounts, we are committed to making digital finance more accessible, iand more secure.

The road to a cashless Bangladesh is not just about replacing banknotes with bytes; it is about empowering people - helping them transact, save, and grow with confidence in a digital - first world. Together, with collaboration between financial institutions, regulators, and the technology community, we can build a future where financial services are not just available, but truly inclusive, driving sustainable growth for our nation.