- info@ficci.org.bd

- |

- +8802222271610, +8802222271611

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

Bangladesh FMCG market today stands at size is ~€3.4bln. It has been growing at a CAGR of ~10% over the last decade. The evolution of the market is the story of the evolution of Bangladesh where in the initial days the market was catering to some basic needs optimized for the low dispos-able income of the mass. As the country evolved and the consumers got exposed to urbanization more and more categories developed. From the humble laundry soap that the erstwhile Unilever Bangladesh, i.e., Lever Brothers Bangladesh, started we have seen the market evolved to synthetic detergents, tiering of the market from mass to mid and premium and now of recent even liquids made foray.

the initial days the market was catering to some basic needs optimized for the low dispos-able income of the mass. As the country evolved and the consumers got exposed to urbanization more and more categories developed. From the humble laundry soap that the erstwhile Unilever Bangladesh, i.e., Lever Brothers Bangladesh, started we have seen the market evolved to synthetic detergents, tiering of the market from mass to mid and premium and now of recent even liquids made foray.

Such stories are in in abundance, should we talk about Oral Care, Hair Care, Household Care where category did not even exist and now these are one of the top markets globally.

2.0 Beyond FMCG

Impacting Health, Hygiene and Lifestyle: While for the common eye FMCG might be play of products, the role it has on changing in impacting our health & hygiene, lifestyle and nutrition is beyond comprehension. While the recent onslaught of the pandemic brought the humble soap on red carpet, the truth is that  soap has been doing this role of saving lives for a decade. The founding fathers of Unilever goes back to the roots of when Lord Lever Hume founded Unilever in the quest of making soaps ubiquitous. A brand called Lifebuoy who's tag line has been "Shastho Shurokhae Lifebuoy”, i.e., Lifebuoy for a healthy life, has been teaching Bangladeshi school children the proper way of hand washing at the tun of the decade. Two decades back, Pepsodent started one of the largest school dental programs in Bangladesh, when Bangladesh had severe challenges with cavities and bad breath due to bad oral hygiene. Lux, the beauty soap of the stars was behind some of the leading starts of today. Even brands like Pureit provides us access to safe drinking water in less than 10 c. Brands like Horlicks goes a long way to address the nutrition challenge of the country. Pran, Fresh, Radhuni et all has made significant inroads for accessible packaged foods. Today we can boast of home-grown Companies that play a pivotal role in the center of our plates. The social impact of FMCG goes into multiples of the market valuation.

soap has been doing this role of saving lives for a decade. The founding fathers of Unilever goes back to the roots of when Lord Lever Hume founded Unilever in the quest of making soaps ubiquitous. A brand called Lifebuoy who's tag line has been "Shastho Shurokhae Lifebuoy”, i.e., Lifebuoy for a healthy life, has been teaching Bangladeshi school children the proper way of hand washing at the tun of the decade. Two decades back, Pepsodent started one of the largest school dental programs in Bangladesh, when Bangladesh had severe challenges with cavities and bad breath due to bad oral hygiene. Lux, the beauty soap of the stars was behind some of the leading starts of today. Even brands like Pureit provides us access to safe drinking water in less than 10 c. Brands like Horlicks goes a long way to address the nutrition challenge of the country. Pran, Fresh, Radhuni et all has made significant inroads for accessible packaged foods. Today we can boast of home-grown Companies that play a pivotal role in the center of our plates. The social impact of FMCG goes into multiples of the market valuation.

• Building a Sustainable and Socially Responsible Ecosystem: Water and Energy conservations and reducing carbon emissions have been the key initiatives in this regard and the company continued to invest its effort to conserve these natural resources and reduce carbon footprint. In the last 11 years, water consumption in UBL operations was reduced by 37%, which can meet the demand of 788 million people for a day.

Energy consumption of UBL operations was reduced by 26%, which could light up more than 2.1 million family for a day. For the same period, Carbon emissions were scaled down by 22% (60,929.26 metric tons) which is equivalent to 2.81 million trees.

Since 2014 UBL continued its journey of "ZERO WASTE TO LAND FILL" by ensuring utilization of 100% solid wastes coming out of its manufacturing operations through partnering with government agencies, other MNCs as well as local vendors by co-processing, re-using, recycling, and recovering energy.

We remain committed to our war on plastics, and by 2022 we will revive our work on developing capability for transition- ing 80% of our packaging portfolio to recyclable structure and crafting a sustainable business model to pioneer organ- ised HDPE/LDPE plastic recycling in Bangladesh. As always, we will continue to utilize our purpose-led brands in Bangladesh to improve the health well-being of every community in this country and develop an inclusive society. Our brands are committed to taking impactful social initiatives under our brands' purpose, such as Dove is on a mission to empower over 5 million young people through DSEP by 2030, Lifebuoy aims to change the hygiene behaviour of 7 lakh children in Bangladesh by 2022, and Domex will help Bangladesh to achieve improved sanitation and hygiene target of SDGS. Finally, we are committed to equipping one million young people with essential skills by 2030 and utilizing the upskill to fuel Bangladesh's growth journey.

• Generating employment: FMCG business model is deeply entrenched into ensuring that we deliver our products to the last mile.This ideally means, if feasible in the hands of the consumers. That has led to design of different disruptive go to market models we resource to serve the consumers. While we have scores of people that generates orders and delivers to the shops.

that we deliver our products to the last mile.This ideally means, if feasible in the hands of the consumers. That has led to design of different disruptive go to market models we resource to serve the consumers. While we have scores of people that generates orders and delivers to the shops.

• Treadmill of Training: FMCG also is the bastion for creating future leaders for the industry. Not only does core FMCG builds the business muscles, but it also creates depth in functional expertise. This industry is not for meek. One needs the ability to have the longer-term birds eye view of what lies ahead while at the same time the dexterity to get into the detail of executional nuances. You must understand how scale works to your advan- tage and how one can sweat the asset to get the best return to the business. FMCG is also the cradle for marketeers, where one needs to be observant enough to get under the skin of the consumers and fish out insights that can be transformed into a commercially viable idea where you create appeal by stoking the imagination of the consumers. Forecasting becomes a science and an art where one needs to do a bit of crystal ball gazing while.

• Treadmill of Training: FMCG also is the bastion for creating future leaders for the industry. Not only does core FMCG builds the business muscles, but it also creates depth in functional expertise. This industry is not for meek. One needs the ability to have the longer-term birds eye view of what lies ahead while at the same time the dexterity to get into the detail of executional nuances. You must understand how scale works to your advan- tage and how one can sweat the asset to get the best return to the business. FMCG is also the cradle for marketeers, where one needs to be observant enough to get under the skin of the consumers and fish out insights that can be transformed into a commercially viable idea where you create appeal by stoking the imagination of the consumers. Forecasting becomes a science and an art where one needs to do a bit of crystal ball gazing while.

• Leadership Factory: FMCG has always been the net exporter of talents.  Many industry stalwarts have dirtied their hands and moved up the ladder from here and expanded their footprint into other industries. This sector is a great grooming ground for anyone who wants to get a 360° view of from the cockpit where you get a bird's eye view of the end-to-end value chain and then need to get into the minute details of the millions of SKUs to decipher consumer and customer psyche. This unique blend only can be acquired through years of experience in this sector and then use that to go into other sector and bring disruption. Today, if we look at the big telecom, fintech and other large industries one will see a huge number of FMCG veterans are at the helm.

Many industry stalwarts have dirtied their hands and moved up the ladder from here and expanded their footprint into other industries. This sector is a great grooming ground for anyone who wants to get a 360° view of from the cockpit where you get a bird's eye view of the end-to-end value chain and then need to get into the minute details of the millions of SKUs to decipher consumer and customer psyche. This unique blend only can be acquired through years of experience in this sector and then use that to go into other sector and bring disruption. Today, if we look at the big telecom, fintech and other large industries one will see a huge number of FMCG veterans are at the helm.

3.0 FMCG Headroom for Growth

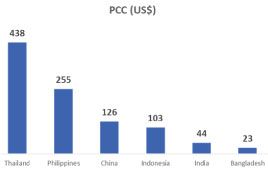

Despite being in the folds for decades, FMCG as industry as substantial room to grow, one such measure is the Per Capita Consumption (PCC) that shows the depth of opportunity. Bangladesh has one of the lowest PCC and countries like Philippines is 10x+ with almost similar economic, demographic, and socio-economic context. Even our neighbor India, where many of the Human Development Index (HDI) are well below Bangladesh, the PCC is significantly higher. As an organsiation we need to reflect and see what role we need to ply as market makers in Bangladesh.

one of the lowest PCC and countries like Philippines is 10x+ with almost similar economic, demographic, and socio-economic context. Even our neighbor India, where many of the Human Development Index (HDI) are well below Bangladesh, the PCC is significantly higher. As an organsiation we need to reflect and see what role we need to ply as market makers in Bangladesh.